Disclaimer: The page number of the 10k page is based on the PDF page number after I downloaded the 10k from SEC. The company's 10k does not include the page number on each page except at the beginning of the report. Therefore, the page number I quoted may not be identical for readers.

(I calculated Net Capex/EBIT(1-t) (before tax operating income) ratios as well, but you can ignore those ratios. I decided not to use that ratio since the EBIT will further exaggerate the differences between different sectors due to different amounts of expenses as % of revenue).

I use the same method to estimate NOWC(net change of working capital), and you can check this link to learn about NOWC's definition and calculation.

R&D

The R&D expense is typical capital expenditure if you check the definition of capex-capital invested today expecting to generate benefits for several years. However, most accountants have recorded them as operating expenses for the current period to reduce the company’s tax liabilities. By doing so, they also largely underestimate the company’s current earnings and future growth. If the company’s financial statement shows R&D expense as the operating expense, we should take the following actions:

1. Add back R&D expenses to the operating income

2. Estimate how many years the R&D can last and divide the expenditure into several years.

i.e. if you think a 5 million R&D can last 5 years, you can subtract 1 million annually for the next five years).

3. Add back ignored tax benefits. Because the company reduces its tax liabilities when reporting R&D as expenses, it will enjoy the tax benefit anyway.

While GE did show R&D for different sectors, the government plays an important role and greatly funds GE aerospace R&D(around 50%).

Figure 12

One thing we know is that when governments give you something for “free,” they usually need to take back and take back more. My first expectation is that the government may have some profit sharing or price fixing since GE Aerospace produces military engines and engines for Boeing, another government-funded company. I tried to search the government website and other sources about the program, but the government website does not clarify how they will share the profit with GE through the R&D they founded. I emailed GE for clarification and showed them I am the current stockholder, but I was transferred to a legal service website. We all know what it is like to talk with a lawyer. Their job is to make you not know what he or she is talking about after five minutes.

While I feel stuck, God seems to listen to me. I finally found the following information on page 56 of the GE 2022 annual report by reading it page by page.

Figure 13

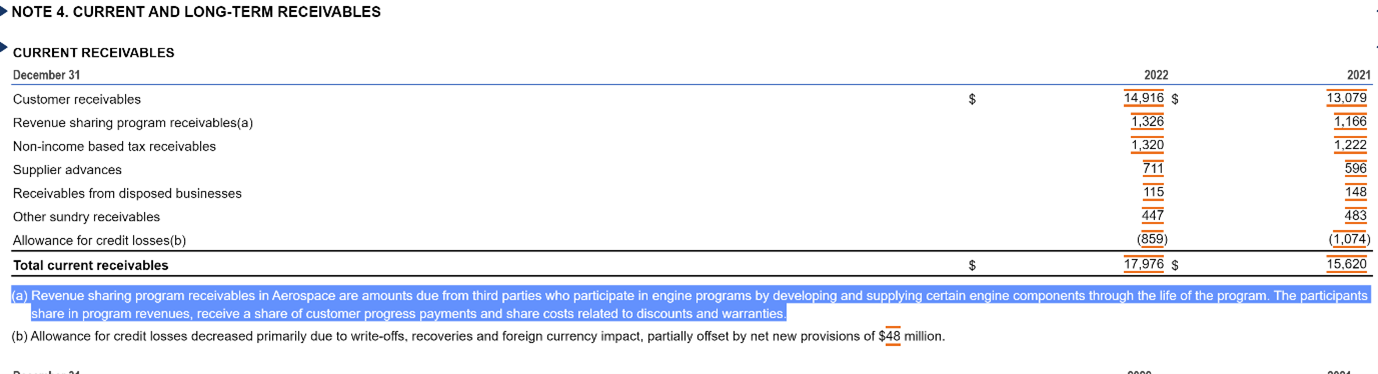

For the revenue-sharing program included in the current receivables, I don’t need to worry about it since we have taken that into account when I subtract NOWC (Non-cash current asset-Non debt current liabilities and current receivable is one of the current assets) from the free cash flow since current receivables are part of current asset.

However, the company also shows revenue-sharing program receivables in the long-term receivables on the annual report. So, if I check the previous 10-15 years.’ annual report, collect the revenue sharing in long-term receivables for each year, and calculate it as a percentage of revenue, I can estimate the total revenue sharing in the long-term receivables. However, after checking 10k reports from 2013 to 2023, I found that only 2019 and 2020 include revenue sharing in the long-term receivables. Accountants mix that up with supplier advances and other non-income-based taxes. But the total amount is only about 1000 million. So, I think I am okay with not caring about that and just considering the revenue sharing by considering the current receivables.

Figure 14

Actions to take on growth rate relating to R&D

Since we have included revenue sharing in the NOWC, and GE only reports GE-funded R&D as an operating expense, we will do the following:

1. Add back, amortize, and calculate ignored tax benefits from GE-funded R&D when calculating the adjusted operating income. Because based on the GE income statement, only the GE-funded part of R&D is included in operating expenses.

2. Include both GE-funded and government/customer-funded R&D in the total reinvestment when calculating the reinvestment rate, ROC, and growth rate calculation. Because both help GE’s growth. We have included the revenue-sharing program in the current receivables in the NOWC calculation to show what GE needs to give by using government/customer-funded R&D.

3. Estimate GE-funded, government, and customer-funded R&D for the future separately. Estimate a time at which the government and customer may decrease or stop the R&D

While it is hard to estimate how much the R&D from the government and customers will decrease over time, we can gradually decrease the R&D amount to the industry average.

Meanwhile, I also need to gradually reduce the revenue-sharing program in the NOWC.

Return on Capital

In this sector, I will concentrate on explaining items that people are unsure about how to incorporate in the valuation rather than basic items such as R&D adjustment and converting lease to debt. To learn those basic items, please check previous posts at link1 and link2.

Estimate price of losing money business

I use reinvestment/adjusted operating income to calculate how much a company earns back to its growth. However, GE renewable energy has been losing money since 2019, and all return ratios have become meaningless. When encountering negative earnings, most investment banks and equity analysts use price/sales or price/product ratios, industry average profit margin, or count positive earning years only. None of these methods make sense to me. The most recent annual revenue for GE renewable energy is USD 12.98 billion, while the industry average market price/sale ratio is 3.2. If I use price/sale*GE sale to price the company like investment banks, GE renewable energy will be priced at around 41.56 billion US dollars. But the GE company's total market capitalization as of January 14,2024 (including Aerospace, Power, Renewable energy, and 13.5% of GEHC) is 141.26 billion US dollars, assigning over $40 billion value to GE renewable energy means the only losing money sector worth around 30% of the company. That will not pass my commonsense check.

I have to come up with other solutions, but I am glad to because

-the pricing does not allow me to take shortcuts, which is good.

-I can take advantage of large price differences between my intrinsic value and price target set by investment bankers and analysts

To figure out how to deal with negative earnings, I need to check the reason and make my own judgment about whether and when the business can return to positive earnings. (I checked the GE annual report from 2019-2022, but accountants have attributed those negative earnings to COVID, inflation, and market trends, which have few meanings in forecasting the future).

For young companies or companies that just had a bad year, like in Covid, they may have negative earnings. In those cases, we can estimate when young companies will turn to positive earnings and check what companies perform in good years. However, that is not the case for GE.

Figure 15

My solution is to first research and forecast whether the renewable energy industry will generate positive, negative, or unsure earnings.

I first collected several publicly traded renewable energy companies (19 companies) similar to GE Renewable Energy, then collected their operating income (EBIT) in the past years. Most of them have some years of positive and negative earnings, and some of them have nearly all positive or negative earnings. (I will explain why I chose 19 companies later).

In statistics, the expected value refers to the expected return from an action. For example, if you can get 100 dollars by rolling a dice and getting a head and get nothing by getting a tail, your expected value is 100*50%=$50. A rational person will pay any amount below or equal to $50 to play this game according to their risk aversion level.

(Of course, I have seen people who are unable to give a price, even if my question is hypothetical. These people usually either save money in the bank and let their assets erode by inflation or put a large amount of money in stock, real estate, or cryptocurrency and only sell when the return is high and just give up when the return is negative and claimed that investment is too risky).

So I count the number of total losing money years. For example, if company A has had five years of losing money in the past 9 years(use 9 years since I cannot find data before 2014 for some companies), I got 5 counts. If company B has two years of losing money in the past 9 years, I got (5+2)=7 counts for the company A and B. I collected all losing counts for 20 companies, including GE Renewable Energy, summed them up, and divided them by 180(20 companies' 9 years of earnings each.) By doing so, I estimated the “Probability of losing money.”

(I choose 19 since the rule of thumb for large sample in statistics is 30 while I found 19 renewable energy companies similar to GE in size and market power. Some small renewable energy companies are not comparable to GE. A politician who wants to buy vote tickets with the green energy campaign is more likely to come to Siemens or GE, rather than an unheard company in Canada).

Figure 16

Example of calculating the probability of losing money in renewable energy.

Figure 17

Estimated Renewable Energy Industry average losing money probability

Discontinued business

Since GE consistently makes sales of businesses, I need to check if I include the sold asset when we calculate the ROC. Suppose GE has 10 billion assets in the power sector and sold 1 billion in the distributed waterpower business in 2018. Then, I should check if that 1 billion has been included in the total assets on the 2018 balance sheet. I think I should add back both the discounted asset and revenue loss due to business disposition because we calculated ROC to evaluate the company’s profitability. If I exclude discontinued business like what accountants usually do, I may overestimate or underestimate its profitability (depending on whether the effect of revenue loss or reducing assets is higher). In contrast, including them can tell me the company’s ability to generate a return from the investment, even if that has been sold. A bad investment is still an investment.

The next question is whether I should use the book value (the accountant's reported value of the balance sheet) of assets and equity or calculate the market value. Usually, I don't use accounting book value because it is the price when the company purchased the asset rather than how much it is worth today. However, by the same token, I can use book value here when calculating ROC. If the company purchased a piece of equipment last year, it makes sense to calculate how much return it gets from the equipment's current earnings(subtract deprecation) and book value(purchase value).

Dealing with Cash Balance

I usually net out cash balance from invested capital since they are not directly related to the company’s operation, such as making investments, manufacturing engines, and distribution. However, as you can see from the picture below, the estimated cash balance for GE Aerospace has been so high that completely netting out will substantially overestimate the return on ROC. The possible reason is that old companies like GE tend to hold a larger cash balance than they need since they have more obligations, like pension funds, while having few investment opportunities as they age.

The solution is to estimate how much of the cash balance is directly related to the investment and how much stays idle.

Figure 19

Wrong Example(Return on Capital for GE Aerospace 2019 when net out ALL cash)

(The return calculator is downloaded from Aswath Damodaran Userful Datasets)

To estimate how much "idle" cash each sector will leave on balance, I collected around 20-30 companies similar to GE Aerospace, GE Power, GE Renewable Energy, and GE Healthcare, collected cash and market security balance and capital(book value of debt+equity+operating lease+cash and market security) from the annual report for last 10 years for each company, and calculate the industry cash/capital ratio. I can use book value rather than market value since most company's financial managers will use book value as the benchmark to decide how much cash they hold. That is not a good benchmark, but I need to estimate from their perspective since they are the person who decides how much cash to hold.

However, Figure 20 shows the aerospace industry's volatile cash ratio has a standard deviation of over 10% (how each data differs from the average of the sample).

Figure 20

Example: Aerospace Industry Cash/Capital ratio

I decide to calculate the aggregate data by adding up all cash balances in my samples and all capital values in my samples to calculate the aggregate industry cash/capital ratio. I gave an example below but calculated the ratio for all four sectors (Aerospace, Renewable Energy, Power, Health).

Figure 21

Example: Aerospace Aggregate Industry Cash/Capital ratio

With the goal seek function in Excel, I can estimate how much of the cash balance is used for investment and how much will sit on the balance idly. For example, since Aerospace has an industry average of 18.13% of cash/capital,I will set idle cash/(total cash and marketable securties+book value of debt+book value of equity+Debt value of lease)=18.13%. All information except the idle cash are available from the balance, and Excel will calculate it for me.

Exploded Return on Capital

When calculating return on capital, I net out cash not invested in the operation and goodwill from the invested capital. Goodwill is the amount of assets investment bankers, and accountants cannot justify when they advise a merger and acquisition deal. For example, if company A spent $1 billion to acquire company B, but investment bankers advising the deal can only justify $800 million assets from company B, they will record $200 million as “Goodwill”. They will attribute the $200 million to things like intangible assets (strong brand name, effective management, strategic benefit) or synergies (1+1>2 effect). It is true that some companies can reduce costs or increase profit margins by working together, but we need data to see how accurately accountants estimate the goodwill. If a company relies on its own growth, has never had a merger and acquisition, or has overpaid to an M&A, there will be no goodwill on its balance sheet.

In accounting, if a company reports $200 million goodwill, for example, but does not achieve the benefit they estimated next year (or the next reporting period), accountants will make up another item called Goodwill Impairment to reduce the goodwill on balance. So if the accountant claimed that the company would generate 200 million dollars more revenue from the acquisition in the next 10 years, but the company shows an increase of only $1 million more next year, they will record $19 million as “Goodwill Impairment.” I can say without exaggeration that the size of goodwill impairment can reflect how much money companies have lost from M&A. Figure 22 below shows how much the Goodwill Impairment from US M&A has increased in past years. From 2016 to 2020, the total Goodwill Impairment amount(AKA how much money companies have lost from investment bankers' advising M&A) has increased from $28.5 billion to $142.5 billion; no wonder many companies have to lay off thousands of employees "due to difficult market condition.", although the "difficult market condition" derives from companies' extravagant spending behaviors instigated by investment bankers' with conflict interest, and justified by accountants' insidious financial reporting.

Figure 22

Goodwill Impairment History of US-based M&A

(Source: Kroll)I decided to check how much goodwill impairment GE has reported for each sector to see how much goodwill I can net out. Interestingly, the accountants did not report debt, expenditure, or equity by sector but did report goodwill by sector, reflecting a fundamental feature of accounting- spending the most time on the least important things.

Figure 27

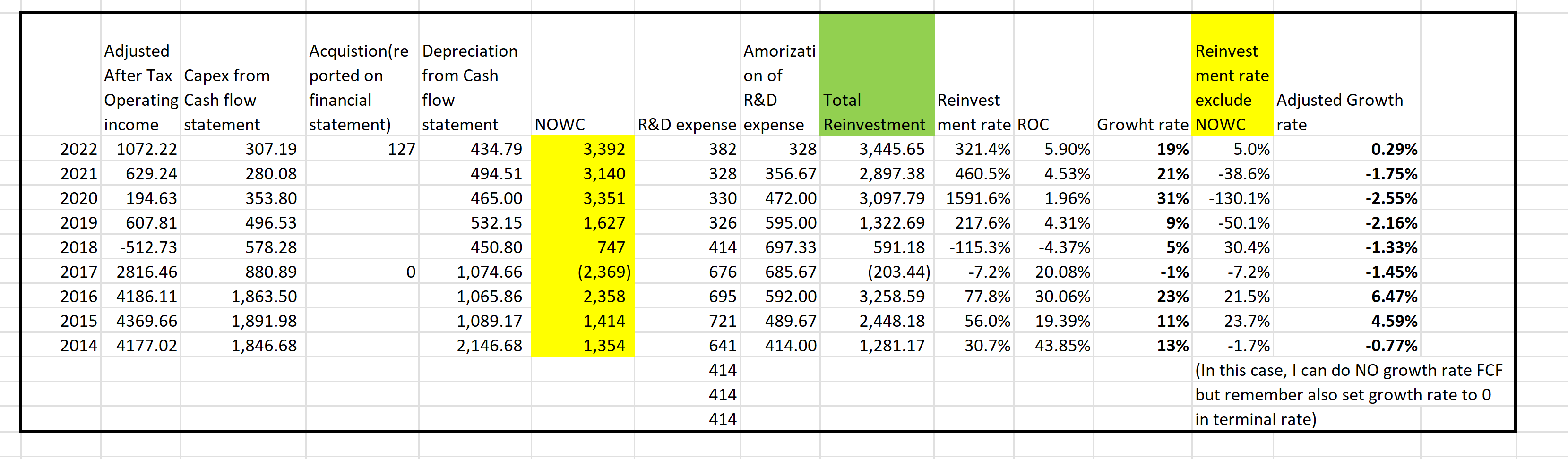

GE Power Growth Rate Estimate

Take a look at the after-tax adjusted income; the income has shown that the company has had little growth for years. However, don't panic about the large income decrease from 2017 to 2018. That is just because GE sold its oil and gas business to Baker Hugh in 2018, so no wonder the income will decrease. Another reason I feel comfortable about excluding the NOWC reinvestment rate is the nature of the business. The NOWC (Non-cash current asset to Non-debt current liabilities) are working capital companies need to maintain for day-to-day business. Companies like Costco or Walmart can hold large amounts of inventory and wait until they are sold to pay suppliers. Semiconductor design companies can ask TSMC to produce wafers for them first and pay after they sell the chips. For these businesses, NOWC does help companies free up more cash flow for reinvestment, stock purchases, or dividends. But what is GE Power doing? GE Power is converting fossil fuels and other energies. Then, I can expect that they will generate few cash flow from NOWC. It would be great if I knew what kind of current assets and current liabilities GE Power has to decide whether or how much NOWC is included in FCF. But GE accountants did not tell me anything about that. In addition, NOWC is part of reinvestment but should not be the major reinvestment. When the company has almost no reinvestment excluding NOWC, while NOWC is proportionally larger than other reinvestments, I should not use that as the company's major reinvestment. When you do stock analysis, you should always pay attention to these situations and align your model with the company's business nature, the industry, and the economic condition. Mechanically filling data to a valuation model will fail to grab the company's specialties and differentiate you from others.

You will notice that my revenue, NOWC, and R&D barely change, and I don't even include the net capital expenditure. Because I expect GE Power to have no growth anymore, it will also have few reinvestments.

Figure 28

GE Power's Free cash flow

On June 7, 2018, Bayer Ag, the German multinational pharmaceutical company, acquired Monsanto, the American agrochemical company, for $63 billion. JP Morgan advised the acquisition.

On November 18, 2023, the Missouri Jury ordered Bayer AG to pay a $1.56 Billion fine for a Monsanto product that can cause cancer.

A company's pending lawsuit could cost significant cash flow in the future, so I have to estimate the potential cost if a company has any.

GE Power Lawsuit

Page 38 of the GE 2023 Q3 quarterly report discloses that the company was involved in anti-competitive activities when it acquired Alstom's Steam Power, Renewables, and Grid businesses in 2015. It also mentioned that it has reserved $416 million and $455 million for legal matters, respectively, as of the end of 2023 and 2022. Based on this link from the U.S. Department of Justice-Antitrust division, I think the $400 million is a reasonable estimate, and I just subtract that from GE Power's operating assets.

GE Healthcare (GEHC) Lawsuit

Page 24 of the GE Healthcare 2023 Q3 quarterly report shows the company has a pending legal lawsuit for providing medical products to a terrorist group in Iraq. Estimating how much fine a company will pay for the anti-terrorism act is a very special case, so I went for my lawyer friend. I explained the case and said, "I know this is a very special case, but I wish I could get some advice regarding "What to search" online, not directly try asking "What it is" from you?". Not surprisingly, she told me she was unsure since that was not her specialty. So, I will use my personal judgment again.

With common sense, I expect the penalty amount for an economic crime to depend on how much the defendant gains from the activity. It would not be the same amount, but it will be the benchmark. So, I just take shortcuts and expect GEHC to pay 10 times its annual revenue from Iraq as the penalty. How do I know how much GEHC earns from Iraq? Check Figure 29. I knew the percentage of GEHC's revenue from countries other than the US and China(two major GEHC revenue regions) is 45.5%, and I calculated how the percentage of Iraq's GDP as of all countries' total GDP other than the US and China as 0.55%. Multiplying these two gives me the estimated GEHC annual revenue from Iraq, and multiplying the result by 10 years is the estimated fine.

Final Result

Valuation

With this analysis, I estimated the fair value for GE stock before spin-off is $97.95/share.

The stock is trading at around $126.88, about 29.5% overvalued.

Figure 32

GE stock price intrinsic value now before spin-off

.png)

Comments

Post a Comment