GE pension fund

(This is part of my GE stock valuation)

Pension funds are pools of money contributed by employers or both employers and employees to provide retirement income. The major types of pension funds are Defined Benefit Plans and Defined contribution plans. Employers promise to pay employees a specific amount of retirement income in the Defined benefit plans. Companies contribute assets to pension funds during employees' working time, expecting the fund to generate returns to cover pension payments after they retire. In Defined Contributions Plan like 401k, employees decide how much income to contribute(with a limit), and the employers will match it.

Estimating pension funds requires us to evaluate the company's business nature, stage of life cycles, and management. Young losing money startups or high growth companies will have lower pension income rates. These companies usually keep employees with stock options to use liquidity more in investment for growth. Mature companies and companies in industries such as consumer staples and utilities will have high pension fund rates. In addition, companies with many mergers and acquisitions, like GE, can also have high lump sum pension obligations since many employees come with the deal

Reading through GE's annual report, I found that the pension fund is a big trunk of the company's financial obligations. As equity investors, we get money after the company pays everyone else, debt holders, suppliers, leases, etc. So it is essential to estimate the present value of future pension obligations and subtract that from the free cash flow of equity when estimating the stock price. I go to the company's 10k to find clues first.

The following screenshot shows the definition of terms in the GE pension plan.

Figure 1

But it also shows an item called Amount Included in Shareowner's equity in the 2017 10k report, with a much larger amount than reported benefit plans balance.

Figure 2

At this point, I am not sure which number I should use to estimate the pension fund obligation.

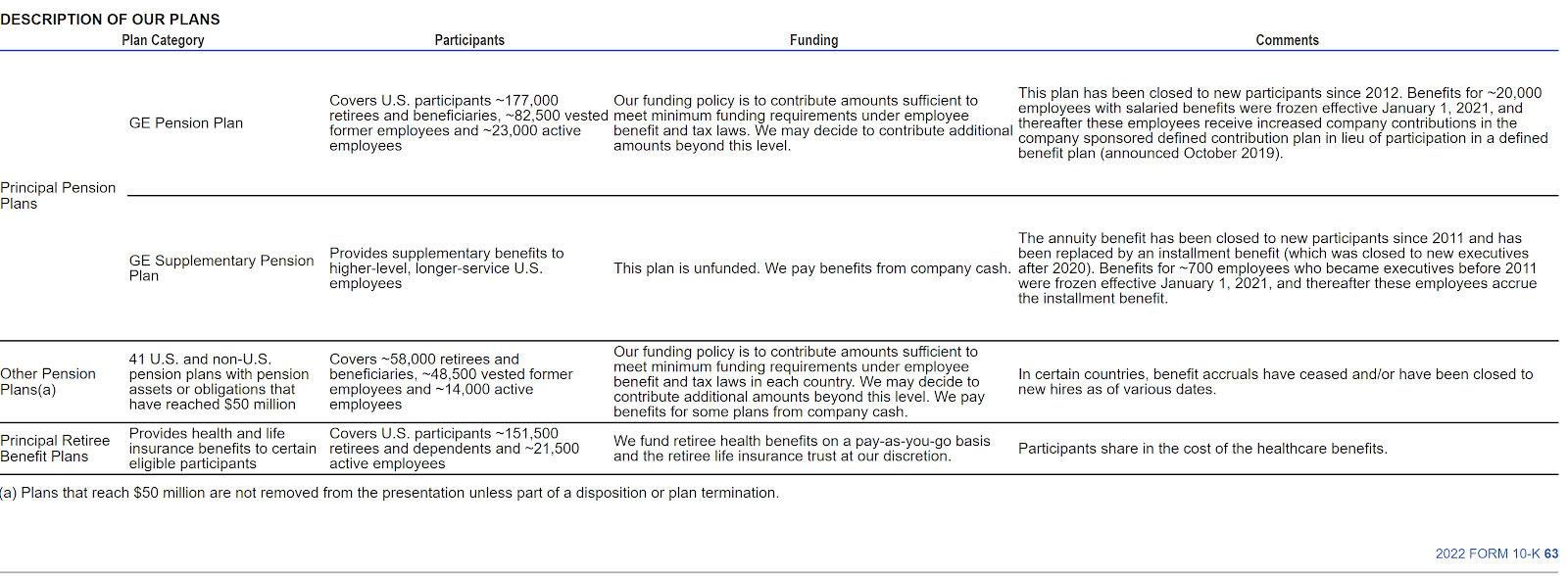

The p63 of 2023 10k lists GE pension funds’ description as follows:

Figure 3

I collected pension expense from GE 10ks in Figure 4 to see if I can figure out some ways to estimate the present value of pension obligations. You can also check explanations of line items on Figure 4 in the following links for better understanding. But from the definition and explanation, there are two issues using these numbers to forecast the present value of future pension obligations.

- Check the definitions of those line items. You will find that most of them are operating expenses about how much money is spent to manage the pension fund during the current operating period. It is like you are taking a loan, and the bank listed services fee rather than the present value of all the principals and interests you owed.

- The most influential line item is the Expected return on assets, which is GE accountants' estimate. Using their numbers will put my analysis at the mercy of GE's accountants. While I prefer doing my work to take responsibility, let alone the accuracy of accountants' prediction. Because if GE accountants are good at forecasting, how come GE has such many losses of money in mergers and acquisitions?

Figure 4

On GE’s 10k, it listed asset allocation for its pension fund.

Figure 5

Figure 6

My solution is to estimate the return rate based on its asset allocation by myself, then discount the expected future pension by my estimated rate. But it would not be easy to estimate how much return the company gets from its financial investment, and using the market average return can overestimate the pension fund performance. After all, even the most active asset managers failed to outperform the market. The SP500 global tracks all large funds in the US and found 93% underperform the market in the past 15 years Link . So, I don’t see how I can give GE’s asset allocation credit.

Expected return to use for GE pension fund:

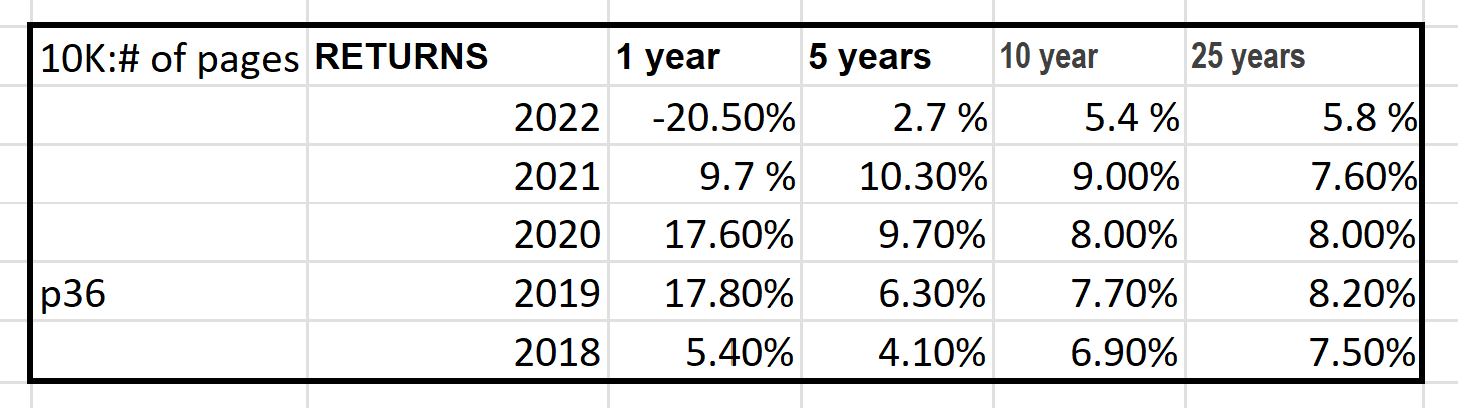

I calculated the standard deviation for GE pension fund’s historical returns in Figure 7, and you will find that the 25 years average return is quite stable. I may use the 7.8% as the expected return for GE’s pension fund asset and discount future pension obligations to today.

One counterargument is that what the company did in the past does not predict its future. If you read my first valuation report, you know I greatly embrace that idea a lot, and that’s why I don’t use industry average growth rate like investment bankers and analysts do.

But for GE, a mature company with 130 years of history, I think it is ok to use the past 25 years’ performance to estimate its pension fund performance. In addition, GE has stopped offering pension for new employees, so we don’t need to worry about pension fund performance after 20 years.

Figure 7

In addition, I can also check if my number makes sense by calculating the historical return for GE capital sector. Although the sector has been spun off, I believe that will give me some information about how GE performs on financial investment. Just think about who will be responsible for handling a company’s pension fund investment. I think those senior employees with years of experience in the GE capital department are likely to be the ones. Even if they have poor performance for years.

Present value of future pension obligation

After we get the expected return on pension fund assets, we may check and forecast how much assets GE will invest in pension fund to calculate numerical return.

But doing so will assume that GE will have enough assets to cover pension obligation, and it would be difficult to estimate how much additional asset the company puts into pension fund. Since the invested asset for pension fund is from the company, and it can use cash, or take debt, or issue new equities to fund it. We just need to discount future pension obligation to today with the expected 7.8% discount rate and subtract that from the free cash flow of equity at the end.

Because say the company put $1billion in the fund and get $78 million return at the end of the day. It will use the 78 million to pay part of pension obligation, and the 1 billion to flow back to the company to used for paying pension or any other expense. By doing so, we also don’t need to deal with additional debt or equity the company raise to fund its pension fund, since we will incorporate that when we calculate market value of total debt to get the cost of capital.

The company’s 10k listed expected pension liabilities and I discount them with the weighted average maturity and the expected return rate. I got $44 billions present value of future pension obligation for GE.

Figure 8

The data on Figure 8 is from the company’s 2023 10K for year ending December 31th, 2022, so will include the obligation for the GE Healthcare, which has been spun off. So, I will need to subtract the pension obligation goes away with GE healthcare later.

After calculating the PV of future pension obligation, I will separate the total amount by headcounts in different sector if I cannot find more information. I can do it because the amount of pension directly relates to how many employees are in each sector.

Comments

Post a Comment