On July 5th, I posted my first stock valuation of Costco in Link and Link2, and I got a price of $966.17.

However, I learned today that I made a mistake when valuing the equity risk premium in part 1-Link.

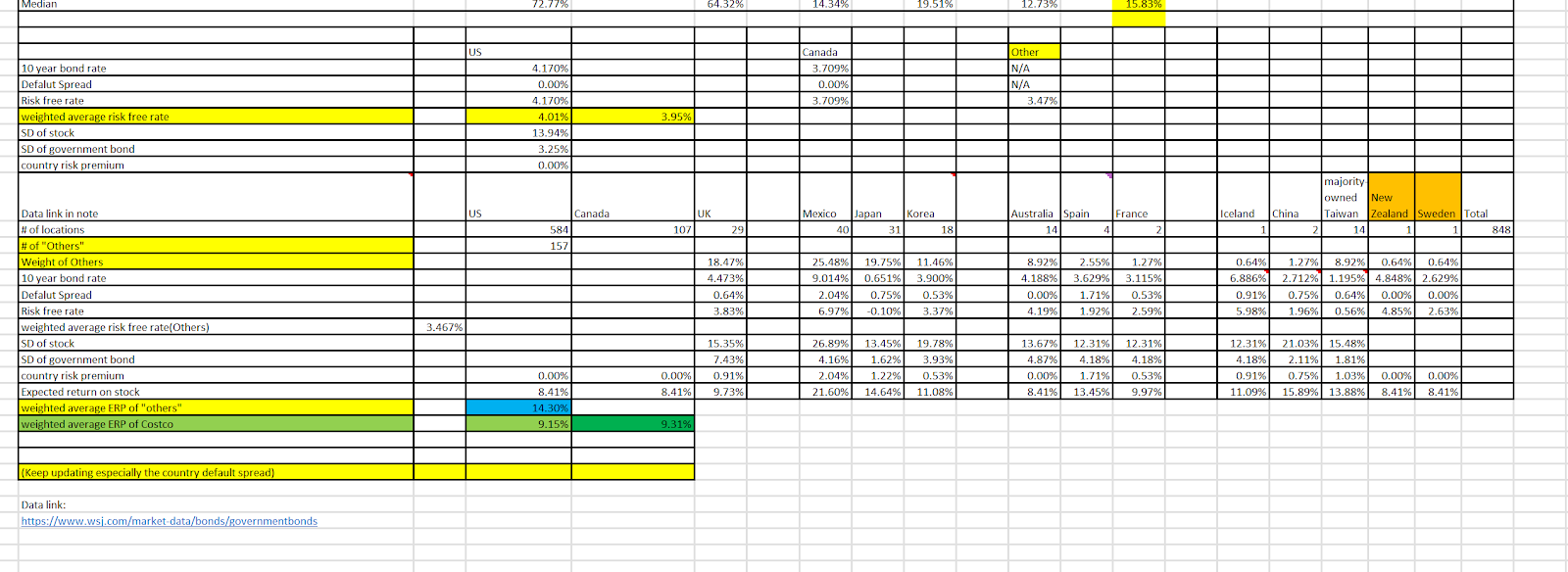

If you check the end of the figure below, I used the implied risk premium from the NYU Stern dataset, which is calculated by the expected return of stock -risk-free rate.

But when I calculate the cost of capital, I use the weighted average implied risk premium as market risk premium to calculate the cost of equity.

But the cost of equity formula is Risk-free rate+Beta*(Expected return of Market-Risk free rate).

So by using implied risk premiums, I mistakenly subtracted risk free rate twice, largely underestimating the cost of equity.

In addition, I used 8.99% as a long-term market risk premium for terminal value calculation. The rate is calculated by my own calculation for US stock return for the past 30 years, which can also be biased.

Today, I found these mistakes and corrected them. I first replaced the implied risk premium with the expected return of the equity market in the market equity risk premium calculation.

Then I updated the current WACC(weight average cost of capital), and long-term WACC for terminal value calculation.

As a result, the stock price before the stock option has been decreased to $782.85.

You can also find that the trailing 12 months' Operating income I projected for Costco one year ago is $8019 million, while right now, the actual number is $7942 million from Yahoo Finance. The actual operating income is 99.03% of my prediction, and I think it is not that bad.

In addition to projected stock options, the fair price decreases to $776.28.

Actions:

One thing I want to mention is that if a stock is trading at a fair price, should you buy it?

I used to think that I should only buy the stock at an undervalued price, mainly because some of my financial professors said, "You want to buy at low and sell at high," a term that is very easy and cheesy to say. But later, I realize that such a word tells you few about trading strategy. Think about it. If you really have a way to value a house, you are interested at 1 million dollars, and the place is trading at 1 million now. Would you buy it or wait for it to get cheaper? I will buy it because it can also go up if I don't buy it. I don't know how undervalued it can go unless there are significant events, such as a recession or expected interest rate hikes due to hyperinflation. There have been several times before when a stock is traded close to its estimated value, and I want to wait for it to be 20-30% undervalued, then I end up missing the opportunity to buy.

But I am not going to buy more Costco stock right now...

Because the 4 shares of Costco stock I bought one year ago have been over 4% of my total portfolio, diversification is one of my investing principal. So I will not buy more.

Instituions

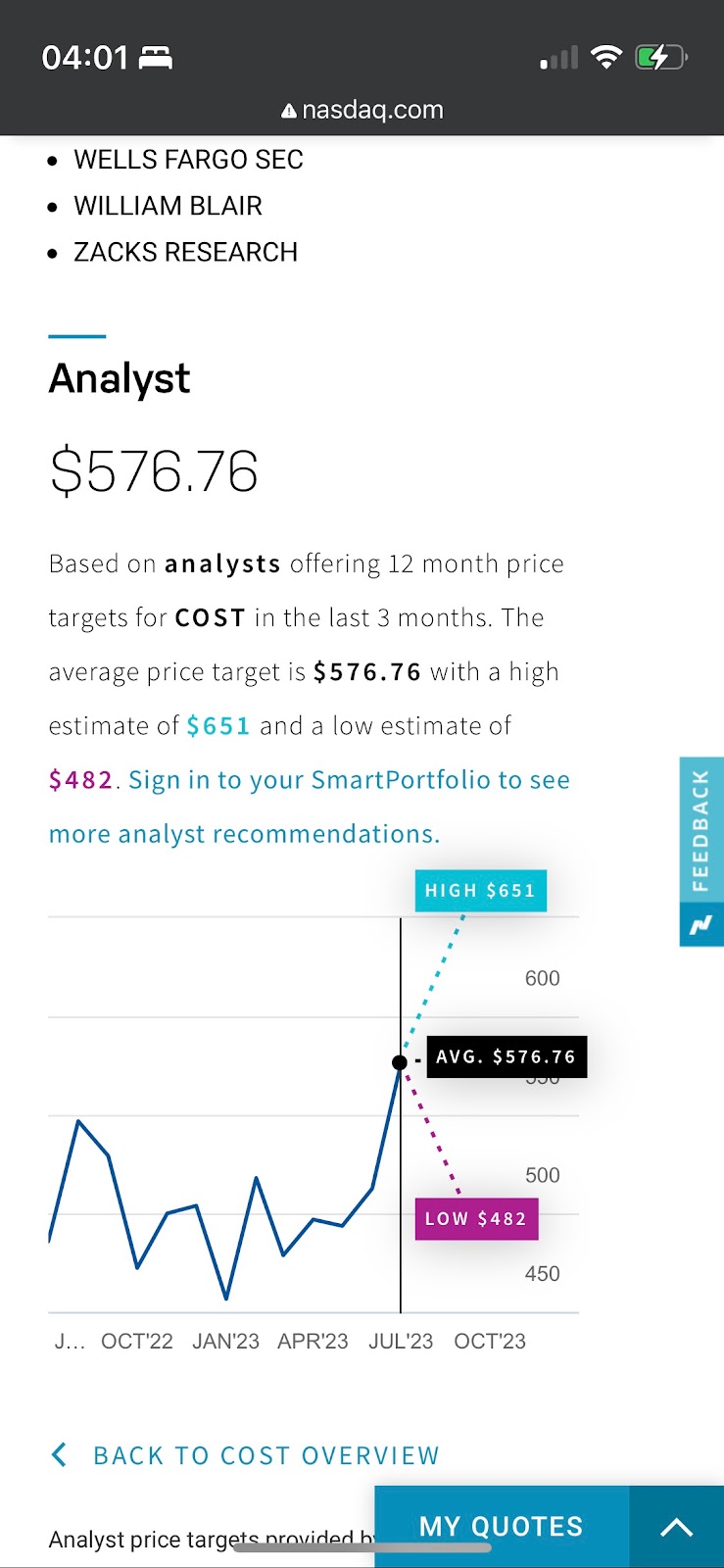

As my course of action, I included instructions' price target update. And you can tell that my valuation is still way higher than the institutions.

I did it not because I cared about their valuation but because I knew that they would not keep a record of what they are saying on their own. If you check my original post Link, you can see their price target half a year ago. And you should notice two things:

1. Whenever one institution updates the price, most others will not only update but update in the same way. You may wonder why? Because most of them go to the same college, play golf and have business dinners together even if they work for different companies, some interesting conversations can happen.

2. The way institutions evaluate analysts is through comparative analysis.

So if all analysts lose 10% on average in a period but you lose 8%, you can keep your job.

But you may be fired if all analysts earn 10% on average and you earn 7%.

So we have different goals. I aim to beat the market and get as high a return as possible, while analysts aim to perform as "industry average." There is no good or bad regarding our goals; they are just different. One is serving for excellence, while the other is mediocre.

I hope you find the post helpful.

Comments

Post a Comment