Note:

Words for Readers

This analysis is meant to teach those with NO investment experience or those who have attended business school but only know how to price a company rather than value a company. If you are interested in learning investment from this analysis, I recommend you pick a company and value at the same time while reading this paper. It took me several days to learn most of the knowledge I used in this paper, but it took several months when I valued the first company (My first valuation is AMD, not for this one, though). Not until you started did you realize that you always have things to figure out. Along the analysis, I will try my best to explain any financial terms you may have never heard of. If you feel confused, please be patient and follow my path. If you still cannot understand some terms, you can learn about them by simply Googling them. Finally, finance is about making predictions and forecasts for the future. Therefore, you may often feel “unsure” or “too general” when I use some data. I felt the same when I started to make investments, but later I realized that finance is about being generally correct rather than detailly wrong. You may have different opinions on the data I use, and that is entirely normal since finance is about making judgments. What is important is not about the numbers themselves but the stories behind the number.

Background of the story

In June 2021, I was offered a credit operation risk analyst job at JP Morgan Chase Bank. The company thoughtfully and maybe intentionally confirmed the offer by calling me. After two days, they called me again and said they could not continue the offer since I needed work visa sponsorship. Ever since that, I decided and started to learn financial modeling and stock valuation purely by myself although I know many international students working in Chase if they would like to pay 100k dollars to go to a US graduate school.

I learned about how analysts and investment banks price stocks for a month by myself before I stopped, as I disagree with most of their work. In my analysis, I will introduce how they price stock and how I value stock, and you can pick with your judgment and ethics. From the beginning of September 2022, I decided to value the stock price of Costco, an American multinational corporation operating a membership-only wholesale warehouse to offer discount products in large bulk. I finished the valuation on September 11, 2022, and decided to revise my valuation in June 2023 during my travel in Turkey. I will also show how my opinion has changed during the revision.

My last valuation returned stock prices between $1357.99 and $1419.94 and revised it to $943.51 in July 2023, while the stock was traded at around $530. JP Morgan gave a $550 price target during that time, but it seems like they are so good at taking down what they have said that I cannot find that news online now. But I do find several other intuitions price targets.

I included my trade record and intuitions' price target because, over my years of financial study, I found that many analysts and financial professionals have gotten used to not taking responsibility for their words. Watching CNBC, you will find that the same analyst can speak different things at different times since no one tracks them.

One of the main reasons I am writing the analysis and keeping these records is to supervise myself and push me to be fiduciary. By exposing myself to the public, I can admit my mistakes and grow when I make them. Otherwise, I will only take credit after I made a capital gain and stay silent when I am wrong. And that is common for most of us since we are human.

I included institutions' price targets not to show our differences but to tell you how ineffective it is to follow others while not doing your work.

Three main reasons led me to choose Costco.

1, In 2022, I expected Costco to have increased sales revenues and stable cash flow when the world economy falls into recession next year (or at this moment).

2, I am so familiar with Costco’s business, and I can easily have access to find out any possible positive or negative changes in the business. (Just by going to the store as I have been doing every week and talking with Costco staff).

3, Institutions such as investment banks or asset management will not spend too much effort on valuing companies like Costco because Costco is unlikely to burn cash on significant acquisitions, and the company is not eye-catching for analysts to talk about on places such as CNBC.

Disclaimer:

-All information used in this valuation is from public information on sources such as the company's 10k annual report, the SEC website, Wall Street Journal, and Bloomberg.

-The analysis is meant to share information, educate financial literacy, and show off rather than offering investment advice.

-Most knowledge I used learned from public sources after May 2020, such as MIT open course, New York University, and Harvard Business School videos on Youtube. Very few (if any) knowledge or skills I used learned from universities or colleges I attended.

-People who read this analysis should not assume they will gain similar knowledge by attending Ohio State University or University Canada West.

Company History and business model

Company Brief

Costco was founded in 1976 by Sol Price and started as the first membership warehouse club exclusively for business members, offering various supplies and wholesale items at discounted prices. In 1983, Jim Sinegal co-founded Costco Wholesale with Jeff Brotman, opened the first warehouse in Seattle, Washington, and merged with the price club in 1993. Today, Costco Wholesale has become a leading multinational wholesale corporation that offers qualified and inexpensive products to business and retail customers. Despite its large size, Costco warehouse only carries 4000 SKU (stock keeping units) compared to the 30,000 supermarket industry average. The small number of SKUs increases Costco’s logistical efficiency and reduces carrying and delivering costs. Costco sells daily supplies at discounted prices ranging in types from food to clothes, electronics, computers, furniture, appliances, tools, equipment, etc. The low price, broad product coverages, and membership relationship enable Costco to consistently attract new customers and enjoy repetitive sales from existing clients regardless of macroeconomic conditions.

Until 2022, Costco currently runs 838 warehouses around the world, with 578 in the U.S,107 in Canada,40 in Mexico,31 in Japan,29 in the UK,17 in Korea, 14 in Taiwan (majority owned), 13 in Australia, 4 in Spain, 2 in France, 2 in China and 1 in Iceland. The global coverage helps Costco withstand currency fluctuations, tariff or tax policy changes, and specific country or political risks.

Business model

The business model is about how a company makes money. In my opinion, Costco’s business model is as follows:

-build a retail warehouse and offer high-quality products at discounted prices to individual and small business customers

-maintaining long-term relationships with customers through membership to achieve repetitive purchases and stickiness.

Business Segments

The company’s revenues mainly come from merchandise sales in the warehouse and membership renewal fees, in addition to a small portion from online sales (7%), food courts, and Costco travel. Costco has three types of memberships. The Gold Star, Membership, and Business membership charge $60 annual fees, while the Executive Gold Star membership charges $120 annually with a 2% Reward (up to $1000) on most Costco purchases. At the end of 2021, 91% of US and Canada memberships and 89% worldwide got renewed, showing a solid attachment between Costco and its customers. The membership fees provide Costco with strong cash flow as the additional membership revenues is disproportionate to additional SG&A (selling, general, and administrative expenses) cost.

Valuation process

Since this analysis is written for people with little investment or finance experience, I will briefly explain how to value a company stock. Readers who have previous experience (or think they have) can skip this part. In finance analysis, we make three important judgments.

1, how many assets and liabilities the company has right now?

2, how the company gets additional funds (by borrowing money or issuing equity) at which cost and how much growth the company can achieve with new investments.

3, how much-left money will the company give back to stockholders in which way? (Giving dividends or repurchasing stocks). As an equity investor (public stock buyer), the goal is to calculate how much free cash flow the company will generate in the next 5-10 years and how much will be left after paying off its debts, other liabilities, or commitments. To achieve that goal, we need to calculate the cost of capital (It might be a new term for you, but I will explain) of the company, the market value of the company’s assets and liabilities (rather than accounting book value on financial statements), and future growth rate.

Step 1, Cost of Capital calculation

Definition

The Cost of Capital is the cost the company needs to bear when they decide to have a new project or run their business. When a company runs a business, they raise capital by borrowing loans, issuing debts, or issuing stocks.

Cost of debt

Borrowing loans or issuing debts incur contractual obligations, which means they must pay a certain interest rate or coupon payment on a specific date. If they cannot pay obligations on time, they may go bankrupt, or at least the lender can prevent them from doing new projects or giving money to equity investors like us.

Cost of equity

In contrast, raising capital from equity does not involve contractual obligation but gives up part of company control. When you hear in the headlines that some activist investors push the company to pay dividends or prevent them from making an acquisition, that is because those investors gain significant control of the company by purchasing their stock shares so they can partly decide how the company runs.

While the company does not promise equity investors to return their investment, stock shareholders can sell their stock to push down company value if they don’t expect the company to have more cash flow. Therefore, the cost of equity is the minimum return the investors expect to get by investing in your company’s equity. And that risk depends on the company’s specific risk, industry, and market. For example, for two almost the same software companies, one is in the U.S. while the other is in Turkey, you will require a higher return from the latter one since they are a higher country risk. Also, for two companies with the same amount of future free cash flow, one is a retailer company while the other is an electric vehicle company; you will also require higher returns from the latter. That is why if JP Morgan stock significantly declines, other banks, such as Wells Fargo and Bank of America, will also have price cuts because they are in the same industry. On the other hand, for two technologies companies, one is 50 years old with little debt while another is a startup with 30% debt, you will expect the startup to generate more returns.

Therefore, valuing a company's costs of equity requires evaluation of the market, industry, and company-specific risk.

Most analysts and institutions will use historical beta for a company by running regression between the company's historical stock price to the market, such as SP500.

Such a method has two conspicuous drawbacks.

What the company has done in the past does not predict the future. For example, Intel may be one of the most successful companies in the past 20 years. But using the company's historical beta will overestimate its risk since it has gradually matured and even stagnated.

The analyst can cook the number based on what data they used. For example, if they want a lower beta, they can compare technology companies to the NASDAQ index rather than the SP500. And sometimes, it is hard to tell which data they used.

Cost of debt calculation

The cost of debt is the cost for a company to borrow money as of today. It is important to calculate current costs as what the company happened in the past does not represent what will happen in the future. When the company comes to banks to borrow loans or issue bonds, banks and bond investors will examine the risk they might be unable to pay off the debt by seeing how much debt they already have and how much money they can make in the future. They would also see how much return they can get by lending to borrowers safer than you to get a benchmark. That’s why we will start with the cost of debt from the US 10-year government bond rate, which was about 3.826% when I wrote the analysis. To make the lenders willing to lend your company money, Costco must promise a higher than 3.826% return, and how high it is correct depends on how likely the company can pay off its debt. If the company has much more income than its interest expense, we expect it to have lower risk, and the lenders will charge lower interest. So, I calculated the company’s annual earnings before interest and taxes over its interest expense (also known as operating income or EBIT) over its interest expense. The result shows how many times the income can pay its interest expense, and the ratio is called the interest coverage ratio. We use EBIT(earning before interest and tax) because companies can claim tax credits when using income to pay the debt. The following graph shows that Costco's annual income can pay around 30 times its annual interest expense.

Figure 1

Costco interest coverage ratio

With Costco’s interest coverage ratio itself, we cannot tell how many more rates the lender will charge Costco. Instead, we have to compare this ratio with other companies in the market to get relative risk. You can find such data from rating agencies like Moody’s or SP Global. From NYU Stern's open source, I can also find similar information as bellows.

Figure 2

Default spread by interest coverage ratio.

Since Costco has about a 30 interest coverage ratio, the default spread is 0.67%, and the cost of debt should be 3.826%+0.67%=4.496%. This was the cost of debt when I started to value Costco, but later I found that I made a mistake. For a long time, there has been an unspoken rule that a company’s rating cannot be higher than the country's. So if Moody’s gives Greece government a Ba3 rating and your company is based in Greece, your rating will not be higher than Ba3, and lenders look to that rating to set interest rates. It is a little unfair, but life is unfair and has its reasoning. Imagine you are a company based in Afghanistan, Donbas, Ukraine, or China, then any political changes will inevitably affect your business. Since Costco runs 838 warehouses in 11 countries, we must consider risks in different regions. To achieve that, we need to quantify the effects of different regions on the company. Since revenues and income determines a company’s cash flow, we can calculate regional effect by calculating each region’s weight (percentage) of total revenue and income. However, I got issues when I tried to get such information from the company's financial report. As the picture below shows, the accountant mixed up all revenues and income in all other regions except U.S. and Canada. But Costco's business in countries like the U.K., Japan, and Mexico will have different country risk and risk-free rates.

Figure 3

Costco geographic distribution

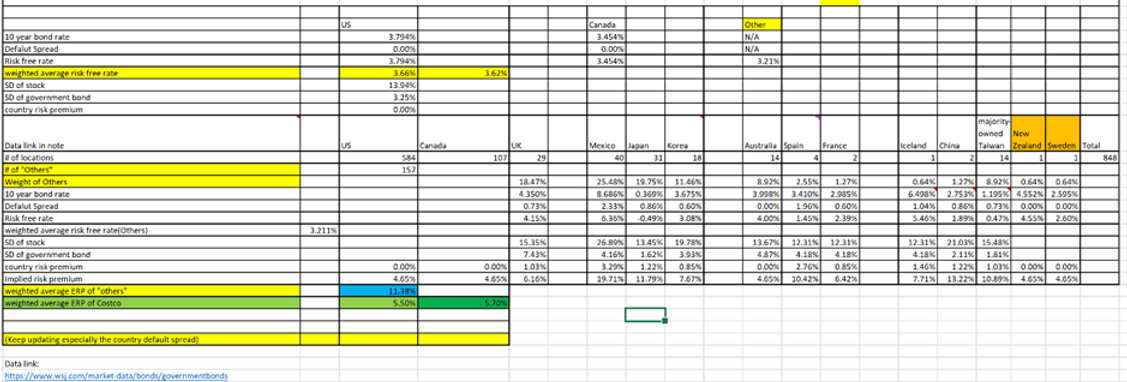

Fortunately, the Costco company website shows how many warehouses there are in each country. Therefore, I give different countries' weights based on # of warehouses. But first, we need to calculate how the weight of the total “Other International,” and I got the following numbers:

Figure 4

Costco's revenue and profit by region

Based on store counts, we estimate that about 72.59% of Costco revenues (Or 63.69% of earnings) comes from the U.S, 14.55% (OR 20.46%) from Canada, and about 12.73%(or 15.95%) comes from Costco warehouses in other regions. With these data, I can calculate the weighted average risk-free rate of “Other International” by multiple the percentage of a country’s warehouse count by the “total other” and the country’s risk-free rate. So say the U.K. has 29 warehouses, and the total “other warehouse” (except U.S. and Canada) is 153. So we calculate 29/153*UK risk-free rate to get how many risk-free rates U.K operations contribute to the “Other International” risk-free rate as a whole. However, since many countries such as Mexico, China, Taiwan, and Europe are not really “risk-free”, we subtract their default spread compared to the US from the government bond rate in these countries to get risk free rate. Finally, we add the weighted average risk-free rate of “Other International” to the weighted average risk-free rate of the U.S. and Canada (their 10-year government bond rate), and we can get the risk-free rate for Costco as a company. Using the revenue method, we got a 3.77% risk-free rate, and using the EBIT method gave us a 3.75%

Figure 5

Costco risk-free rate calculation

We calculate Costco's debt cost by adding the default spread as 4.436%. This is the rate Costco needs to pay if it wants to borrow money today, and next, we will use this ratio to calculate the present value of the debt Costco has borrowed.

Figure 6

Costco's cost of debt

Market Value of debt calculation

Accounting financial statements and investment bankers use the book value of debt to evaluate the company’s risk. The book value is the value of debt when it was taken. So if a video meeting company has a $75 million debt taken in 2020, the accounting statement will still record that as $75 million in 2023 if the company hasn’t paid back any principal yet. But the value of the debt should decrease now since the company’s profit will sharply drop compared to 2020, so that has higher default risks. Many people will feel confused when they hear the term value of debt because they think debt is a liability. But

The solution is to calculate the market value of the debt, like the way to calculate the bond's market value. Recall that when you bought a corporate bond, you lent the corporation a fixed amount of money called principal, you received the interest payment each period called coupon payment, and at the end of the period, the company pays back the face value of the bond. The bond still has a market value because you can sell it to others before it matures, and the higher the risk, the higher the market interest rate, and the lower the bond’s market value and vice versa. We can easily calculate the bond's market value with coupon payment, maturity, the face value of a bond, and market interest rate.

Since I have calculated the market cost of debt for Costco, I can easily calculate the market value of debt with the face value of debt, annual interest payments, and weighted average maturity.

The Formula to calculate the market value of debt is as follows:

From the company’s 10k report, I collected information about the company’s debt by maturity and calculated the weighted average maturity of 6.08 and the total book value of debt $6731 million.

The p51 of 2021 10k mentioned the “Other long-term debt consists of Guaranteed Senior Notes issued by the Company's Japanese subsidiary”, and I just gave it five years maturity based on average bond maturity in other major Japanese companies such as Softbank. The 2021 10k reported $171 million interest expense, and I calculated the market value of debt as $7630.5 million with the formula above.

Figure 7

Market Value of Debt on Balance in 2022

I updated the debt value with the most recent 2023 Q3 report and annual interest expense of $158 million from the most recent 10k Form. I calculated the updated market value of debt as $7247.67 million with the formula above.

Figure 8

Market Value of Debt on Balance in 2023

Leasing

But these are not all the debts the company has.

Imagine you are a department store with a 3-year rental lease with the mall you are in. You always need to pay the rent even if you sold a few products in 2020. We should consider leasing expenses as debt since they are contractual obligations the company will pay anyway and will cost cash flow. Otherwise, they can be used for projects, buybacks, or paying dividends.

Operating leasing vs Financial leasing

When analyzing leasing, you must first differentiate operating and financial leasing since the different classification affects the company’s debt and earnings. -Operating lease:

The operating lease is usually shorter than the asset's life, and the prevent value of all future payments is lower than the asset's value. At the end of the lease, the leased equipment or other physical assets will revert back to the lessor.

For example, department stores like Macy’s will lease certain commercial property for several years and pay rent rather than owning the property.

-Financial or Capital Lease:

The financial lease usually lasts for the asset's life, and the lease payment's present value usually covers the asset's value. The lessee usually cannot cancel the lease, which can be renewed at a reduced price or acquired at the end of its life. The tax and insurance obligations usually transfer from the lessor to the lessee. Over time, the lessee reduces lease payments, resulting in what we call net leases.

The accountants have the incentive to record leases as operating leases since they will become operating expenses for the current reporting period, consequently reducing the company’s tax liability.

The Financial Accounting Standards Board (FASB) specifies a lease as a financing lease if it means any one of the following four conditions:

1. The life of the lease is at least 75% of the asset’s life.

2. The ownership of the asset is transferred to the lessee at the end of the life of the lease.

3. There is a “bargain purchase” option whereby the purchase price is below the expected market value, increasing the likelihood that asset ownership will be transferred to the lessee at the end of the lease.

4. The present value of the lease payments exceeds 90% of the initial value of the asset.

All other leases are treated as operating leases.

The IRS has the following rule to determine if a lease is tax deductible:

• Are the lease payments on the asset spread out over the life of the asset,or are they accelerated over a much shorter period?

• Can the lessee continue to use the asset after the life of the lease at preferential rates or nominal amounts?

• Can the lessee buy the asset at the end of the life of the lease at a price well below market?

Suppose the lease payment is made over a period much shorter than the asset’s life and the lessee is allowed to continue leasing the asset at a fixed amount or buy at a price lower than the market. In that case, the IRS may view it as a loan and prevent the lessee from deducting tax liability with the current lease payment.

Effects of different categorization

Balance sheet effects

Treating a lease as an operating lease will generally reduce the balance's book value of debt and capital.

Income statement Effects

Treating a lease as an operating lease usually will reduce the operating income and tax liability since accountants record them as operating expenses.

Adjustment in Valuation

To incorporate the effects of an operating lease, we need to add back the operating expense to the operating income and add the market value of the operating lease to the company’s total debt.

By doing so, we can have a more reflective operating income and the debt showing the company's real risk.

We don’t need to adjust the tax benefit since the company has received the tax benefit and that has been reflected in operating income anyway.

Financial leasing usually will have been considered as debt by accountants.

Leasing for Costco

Figure 9

Costco 2021 Income Statement

As you can see from Figure 9, Costco’s accountants didn’t record the leasing expense as an operating expense as most accountants, so that saved our work for leasing effects on earnings.

But we still need to calculate the present value of the operating lease to calculate the company’s total debt.

Market Value of Leases Calculation

As Figure 10 shown, the accountants included current operating leases and financing lease liabilities in the “Other current liabilities” and the Long-term Finance lease in the “Other long-term liabilities.”, aligning the leasing classification we just explained.

Figure 10

Costco Leases on 2022 10k

So when I calculated the market value of debt in 2022, I added the $2642 million long-term operating leases to the total debt because I had included financial leasing by calculating the market value of total debt on balance. I didn’t need to include the current lease liabilities since they will be paid for the current year.

Figure 11

Costco market value of debt 2022

However, I found I made a mistake when I revised my valuation.

As you can see from Figures 12, 13, and 14. The total long-term debt for 2021 is $6692, and I used that for the market value of debt calculation, but that does not include the Finance Lease liabilities. An updated market value of debt calculation will include that as well.

Figure 12

Costco Liabilities on Balance Sheet 2022 10k

Figure 13

Costco debt in 2022 10k

Figure 14

Costco Lease liabilities in 2022 10k

Market Value of Leasing Revised Calculation

When a company has leases, they usually pay the same or similar amount of payment for a period. For example, if the company leases equipment for ten years, it may pay $500 thousand annually over five years. So, we can use the annuity formula to calculate a lease's present value.

In finance, the annuity refers to a contract in which one party pays a guaranteed amount to the other over a period. The PV of the annuity formula is as follows:

Figure 15

Annuity Formula

But as Figure 16 shown, it has different payments, but the amounts are similar.

Figure 16

Lease payments

I first tried to get the average lease payment per year based on all records we have in the past. And then, I calculate the PV of the lease payment with the average annual payment and the PV of the annuity formula.

Figure 17

Present value of leasing calculation

We can test if the amount we got makes sense with another test. As you can see, the long-term operating lease liabilities are similar each year while the finance leases are increasing. The p53 of the 2022 10k Form also told us that the average maturity for operating leases is 20 years, and for financial leases is 17 years.

Figure 18

Costco leases maturity

We can also calculate the Present value of Long-term leasing liabilities with a simple present value function.

PV=total FV/ (1+cost of debt) ^maturity

So the PV of total leasing liabilities=

2482/(1+cost of debt)^20+2642/(1+cost of debt)^17

Figure 19

Costco current leases

Try out the formula, and you will find that the leasing amounts are similar.

The Costco accountants do give the discount rate, which is close to the cost of debt I calculated. You can use that, but it would be better to calculate by yourself since not every company will give you that information, and you cannot assume their discount rate reflects the current market risk.

Figure 20

Updated Costco’s total debt in 2023

Cost of equity calculation

To calculate the cost of equity, we need to know the overall equity return the specific company and security is in, then analyze how riskers the company is relative to the overall market.

In finance, there is a formula for that, and the formula is as follows:

Cost of equity=risk-free rate+ Beta*(market risk premium-risk-free rate). The risk-free rate is the return rate you can receive by investing in securities with almost no risk, such as the 10-year US treasury bond. Since the U.S. government sells bond, and most of us think that the U.S. government is unlikely to go bankrupt, that can be the risk-free rate.

Then we need to calculate how much risker the equity market and the specific company are relative to the risk-free rate. Beta is the formula that is just a statistical number to analyze such relative risks. If you check the formula, you can tell that Beta is nearly the only number to determine the company’s equity risk since the risk-free rate and market risk premium will be the same for all companies in the same market.

Beta calculation

Most investment banks and analysts will use the historical beta for the company they evaluate. The issue of doing it is that a company's performance in the past does not predict its future.

The solution is to collect information on all companies similar to Costco. Although these are all historical betas, it includes many companies in the industry. Some are young and old; some may have previous high growth, and some may be growing. But when we use a large number, the power of statistics will even out the outlier. Like in every customer survey, some people may give much better or worse feedback than others, but you can have a comparatively reflective result if you survey many people. We use such a method based on the logic that, at the end of the day, Costco will gradually change from an industry star to an average wholesale company.

When choosing similar companies, it is essential to check the business nature. Some companies also sell food and daily stuff, but they are quite different from Costco. For example, Wholefoods may not apply since Costco is not the kind of place to sell you a bottle of water for five bucks. That does not mean Wholefoods is terrible, though. They are just selling different things. Costco sells discounted goods while Wholefoods sells brand names and the feeling of aura.

You can use the Excel functions to autofill the company's Beta and market capitalization if they are in the Excel database.

Of course, you can use more than 30 companies. I use 30 because that is a generally significant sample size threshold in the statistics.

Figure 21

Bottom-up beta calculation

But the average and median beta is calculated in such a way that is based on the debt the whole industry took. In Finance, it is called the levered beta. If Costco has less debt, it will be less risker and thus has a lower beta than the industry and vice versa. We calculated the industry debt/equity ratio to get the unlevered beta for the industry. (Beta without debt).

The formula to convert levered data to unlevered beta is as follows:

As shown in Figure 23 below, we have the company's median beta, median D/E ratio, and median tax rate, and we can calculate the industry unlevered beta.

But this beta also includes the company’s cash balance, and cash usually has much lower risk than equity and debt. So we calculated the business unlevered beta with the formula as follows:

The cash balance, total debt, and market capitalization can be obtained from the company's financial statements and third-party information such as Yahoo Finance.

Figure 22

Wholesale Business Unlevered Beta in 2022

Figure 23

Wholesale Business Unlevered Beta 2023

The 0.6054 beta we calculated is the industry average beta for the wholesale companies assuming no debt. We take out the debt effect here so that we can take Costco’s specific debt/equity ratio.

As I mentioned, beta is a ratio to measure a specific company’s risk relative to the overall market. A beta larger than one means the company is risker than the overall market, and a beta smaller than 1 is less risker. The wholesale companies usually sell daily necessities and will have few sales decreases even during the recession. So, the 0.6054 beta we calculated makes sense.

Now we have or can get the following data easily:

-Costco’s total market value of debt

-Costco’s total market value of equity (price/shares * total shares outstanding)

-Costco’s tax rate

-Costco’s industry average unlevered beta

So the Costco levered beta=Wholesale business unlevered beta*(1+(1-Tax rate)*Costco D/E ratio)

As you can see in Figures 24 and 25, the beta I calculated for Costco is 0.577 in 2022 and 0.594 in 2023. From the number, we can infer that Costco is less risky than the average wholesale company, which also aligns with common sense.(The data will be slightly different from Figure 22 since I used live data and they keep updating)

Figure 24

Costco’s beta 2022

Figure 25

Costco’s beta 2023

Market risk premium

Since Costco has operations in different countries, again, we calculated the weighted average market risk premium based on how percentages of warehouses in each country in Figure 4.

Figure 26

Market risk premium calculation in 2022

Figure 27

Market risk premium calculation in 2023

The way to calculate weighted market risk premium is similar to that of cost of debt calculation, so I will not repeat the process. But the difference is that, in the cost of debt calculation, we use country default spread to calculate countries’ cost of debt based on the government bond.

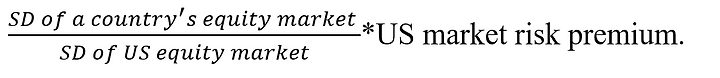

In contrast, the market risk premium is based on a country’s equity market risk. So I use the formula as follows:

With SD means standard deviation.

The standard deviation is just a basic statistic definition that you can search by yourself.

By using the SD of a country’s market, Mexico, for example, we can know how risky Mexico’s market is relative to U.S. market and qualify it by multiplying the US market risk premium.

To find SD for each market, I took some shortcuts. Many rating agencies, such as SP500, have indexes for different countries. These indices covered the majority of public companies in that country. So I just take the SD of a country’s traded index as the SD for that equity market.

Cost of capital calculation

With all of the data above, I calculated the cost of capital for Costco in 2022 and 2023 in Figures 24 and 25 with the formula as follows:

This formula is called capital asset pricing model (CAPM) formula and is the most widely used formula in financial valuation. And I calculated 4.77% cost of capital for 2022 and 4.67% for 2023.

In other words, this is what the market expects a return to receive by investing in Costco stock. So later in the Free cash flow analysis, if the company’s expected cash flow for next year is 11 billion dollars, you will use 11/4.77% to get present value; If the expected cash flow after next is 12.5 billion dollars, you will use 12/[(1+4.77%)^2] to calculate present value and so on.

It is important to notice that just like a man will go through their lifecycle, so do companies. We were born, grow, matured, and aging, someone went to heaven, and some became prestigious investment bankers and accountants. A company also goes through the process. There is a point of time in which the company is matured and cannot grow faster than the overall economy. So, we will also calculate a long-term cost of capital with debt/equity ratio, beta, and market premium for a matured company.

When that happens, the growth rate of the company’s earnings will also be equal to or smaller than the overall economy. The logic is simple. If the U.S. overall GDP grows 3% a year on average, while some companies keep grows over 10% for the long run, there must be some slow, no growth, or even declining companies.

Regarding Costco’s business model and the products it sells, I expect it will have roughly the same growth rate as U.S economy, with an industry average debt/equity ratio and risk premium after 10 years.

Tax rate

While I have covered the cost of capital calculation, it is necessary to explain which tax rate to use.

Traditionally, the tax creates few benefits to business and society and is one of the reasons why the US became independent. But today’s businesses can play with tax rules to get tax benefits. For example, many technology companies record R&D(research and development) expenses as operating expenses for the current year, enjoying large tax benefits although those are investments expected to get a return for the next 3-5 years.

We don’t need to worry about that issue for Costco, but as a company with global coverage, we still need to make the following decisions:

1. Whether we use the U.S. (the parent company’s location) tax rate or the global tax rate?

2. Do we use the effective or marginal tax rates? The effective tax rate is the total tax payment/total operating income. While the marginal tax is the tax paid on “every additional dollar earned as income”.

Figure 28

US personal income tax rate(just for explanation purposes)

Take U.S. personal tax as an example. If you make $62,735 in 2023, your marginal tax rate is 22%.

The U.S. law requires corporations to pay U.S. corporate tax if they bring overseas income back to U.S., even if they had paid tax locally. So, there is an incentive for multinational companies to leave income overseas as long as the U.S tax rate is higher. My planned solution is to calculate the current effective rate for the past 5-10 years and expect Costco to enjoy such a tax rate. But as for the terminal value calculation, I will use the expected U.S. corporate tax rate because they will bring it back at the end of the day.

So I got corporate marginal tax rates for countries Costco operates in and calculated the weighted average marginal tax rate based on the percentage of warehouses in each country.

Figure 29

Costco weighted average marginal tax rate in 2022

But when I revised my calculation, I found that doing so would ignore possible tax benefits the company is having now. Many companies can pay low tax rates for a while if they have good accountants or enjoy some subsidy in a certain country. For these companies, we need to estimate how long that benefit will last and gradually increase the tax rate to the marginal tax rate over time.

Figure 30

Costco's effective tax over time

Figure 30 shows Costco’s effective tax rate over time. At first thought, I planned to use the average tax rate and gradually increase it to a 35% marginal tax rate after year 5.

Figure 31

Costco's income tax rate over time

But if you check Figure 31, the main reason for Costco’s decreasing tax rate in the past 5 years thanks to Trump’s Tax cut. So when people ask the government to increase taxes, the companies most people like to go will always take a hit. Technology companies usually will not be affected since they have many ways to lower their taxes, and we will cover them in other valuations.

And I expect the marginal tax rate to return to 35% in 2024, and I will use the 32.94% weighted average tax for the next 10 years and 35% for terminal calculation.

Attention:

To be consistent, you will use the same rate for calculations of the cost of capital, net income, and other possible tax-related items such as tax benefits.

Part 1 Sum up

In this part of the analysis, I covered how to analyze the business model, cost of capital, and risk premium. These are usually things that happen in the past or now rather than in the future. In other words, we mainly work with things we know. In the next part, I will show you how to make an estimation for the future so that you get the stock's intrinsic value.

Comments

Post a Comment