Acquisition and private company valuation

Acquisition refers

to the transaction in which the buyer (called the acquirer company) purchases part

of or another whole company (called the target). The acquisition can have long-term

effects on the parent company for several reasons:

1.

Parent

companies may use cash, take debt, or issue new equity to complete the

compensation. An over-paid acquisition can burn the cash balance, increase the company’s

debt leverage, or decrease the company’s equity quickly.

2.

Most

acquisitions claimed to be 1+1>2, but the failure rate for M&A is about 60-70% from multiple sources such as McKinsey and Harvard Business School

review.

3.

The

target companies may carry out implicit liabilities such as pensions and pending

lawsuits when they purchase another company. After Bayer AG, the German pharmaceutics

company, bought Monsanto, the American Agricultural biotechnology company, the

value of Bayer AG has been largely affected by investor’s expectations of the

result of the Monsanto lawsuit, which may end up with the company paying up to $11 billion

for some Monsanto’s product which may cause cancer.

As an equity

investor, we receive money left after everyone else (suppliers, company

employees, bond holders, rental lessor, plaintiff, etc.). We must value how much

the acquisitions are worth and estimate how much capital gain/loss by comparing how

much the company pays.

However, many acquisitions

are private companies with no public financial statements. How do we value

these companies? To answer that question, let me explain first how investment banks

and private equity price private companies. For example, if they want to price a private

ride-sharing company, they will collect several other ride-sharing companies

such as Uber, Lyft, Didi, etc. Then, they calculate the company’s price/EBITDA

(earnings before interest, tax, depreciation, and amortization) ratio. Then, they

use the private company’s EBITDA to multiply the industry average price/EBITDA

ratio. If they find that the company they want to price is losing money, they

may try the price/sales ratio. If they find that the company has few revenues,

they use things like price/users, price/daily active user ratios, etc. You may expect

these investment banks to know some rocket science, but these are what they really

do when advising M&A.

While you can tell

that these actions are too general to estimate how much the company actually WORTH,

I can use a similar way to estimate how much the acquirer PAYs. Because the

M&A is advised by investment bankers, using their mindset can estimate a

relative price the company pays for undisclosed M&A deals. On the other

hand, to value how much the company is WORTH, you need to run a free cash flow valuation

like the way I value each company. But you may wonder how do you do FCF valuation

for a private company with no financial information disclosed? Just think about

it. If you want to value a computer company, this company will not be

the only computer company in the world. You have Dell, HP, Lenovo, Acer, Asus, etc. You can first collect a large sample size and estimate how many computers

they sell on average and how much they sell each computer for. Then you compare

your private company with the industry average to ask yourself, “: Will this

company sell fewer or more computers than the industry average? Can the company

set a higher or lower price than the industry average?” Your estimation needs to

align with your company’s business model. Lenovo may not have as high a profit

margin as Apple’s Macbook, but they have much higher market share and more

numbers of computers sold.

With that being

said, let me give you three real examples of how I value Oracle’s acquisition when:

No revenue or

earning data but an estimate;

Cannot even value

revenue or earnings but has side information.

No earning/revenue

data, no side data.

1.

No

revenue or earning data but can estimate.

In

2020, Oracle acquired Nor.1, a platform to propose hotel offers. Recall

that when you book hotels online, some websites will propose a time-limited

price discount or free room upgrade, which is what the company is doing.

First, I researched

how these kinds of companies generate revenue, and it shows they charge hotels on per room per month. Then I found this paper

showing that the average price for a hotel guest to charge the hotel is $2-10 dollars per room per month, which is $24-$120 per room per year.

So, if I know

how many hotels are Nor1 clients and how many rooms each hotel has, I can estimate

how much revenue Nor1 can collect.

This link

the average room numbers per hotel by chain type from 2017-2020. I use the data

from 2017-2020 since the deal happened in 2020, so investment bankers will likely use historical data.

I need the data by

chain type since some hotels are upscale, some are average, some are large brands,

and some are small local hotel chains. And they will have different average total

room counts. And recall that I calculated the price per room per year at

$24-120? I expect the large hotel brand to get the middle price of the range;

the middle hotel pays a little higher, and the small hotels pay the highest.

In the data above, I used the average rooms for the industry, but later, I found all the hotel clients

of Nor1, and I can easily find how many hotels and rooms each brand has on

their website. I found Nor1 clients from public information and places such

as Nor1’s official Twitter and LinkedIn. Usually, when companies have

new business clients, they will announce publicly.

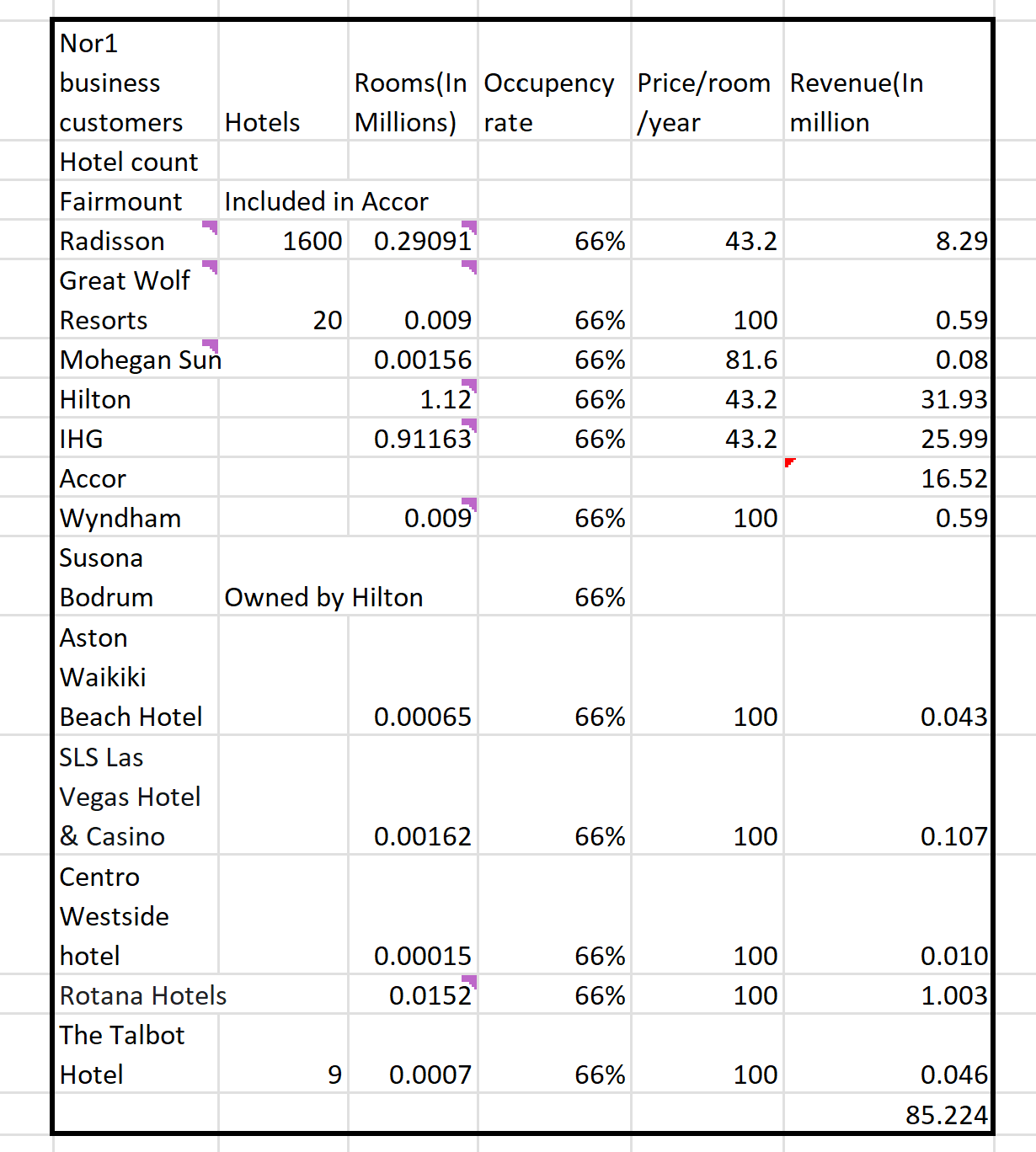

Figure 1 shows

all hotel clients Nor1 have, based on my research, how many hotel and rooms they

have. But later, I realized that using the total room number will assume all rooms are

booked for the whole year, overestimating the company’s revenue. So I multiplied

by the room with the average occupancy rate.

(The Accor in Figures 1 and 2 is a large upscale hotel group, so I estimated it individually

by checking how many sub-brands it has).

Figure 1

Nor1 business

clients

Figure 2 Accor’s brands

With this

information, I estimate the discount cash flow for Nor1.

Notice that Nor1

is a technology company for hotel bookings. So I use the growth rate for hotels

as the revenue growth rate, but I use the profit margin and cost of capital for

software companies.

Figure 3 Nor1

DCF valuation

Then, my next

question is, should I add a premium for the result?

The following graph

from the Statista.com shows how much the acquirer paid to the target company in

addition to the market price.

(Source: Statista.com).

In the beginning, I added the premium to the price I calculated, thanks to my personal bias toward the M&A. But later, I realized that the companies Oracle bought were mostly private companies. In fact, private companies usually need to get price discounts rather than premiums since they are not illiquid. When the company wants to buy a public company, the stock market will show roughly how much the market thinks it is worth. So, the company must pay some additional capital in addition to the market cap. In contrast, a private company is not traded, and the buyer has more room to negotiate the price.

This Link

from NYU Stern School shows the average illiquidity discount based on the

company’s size and revenues. So, I gave Nor1 a 27% illiquid discount and got $287.76

million.

But I cannot

assume that investment bankers who advise Oracle will have similar common

sense, so I also priced the company the way investment bankers do. And

pricing is easier. I just use my estimated operating income(EBIT) for next year

to multiply the price/EBIT ratio.

Figure 4 Nor

1 Pricing (investment bankers/accountants way)

I got the average

of my DCF and simulated pricing, and I expect Oracle to spend $429.568 millions

for Nor1.

2. Cannot even value revenue or earnings but have side information.

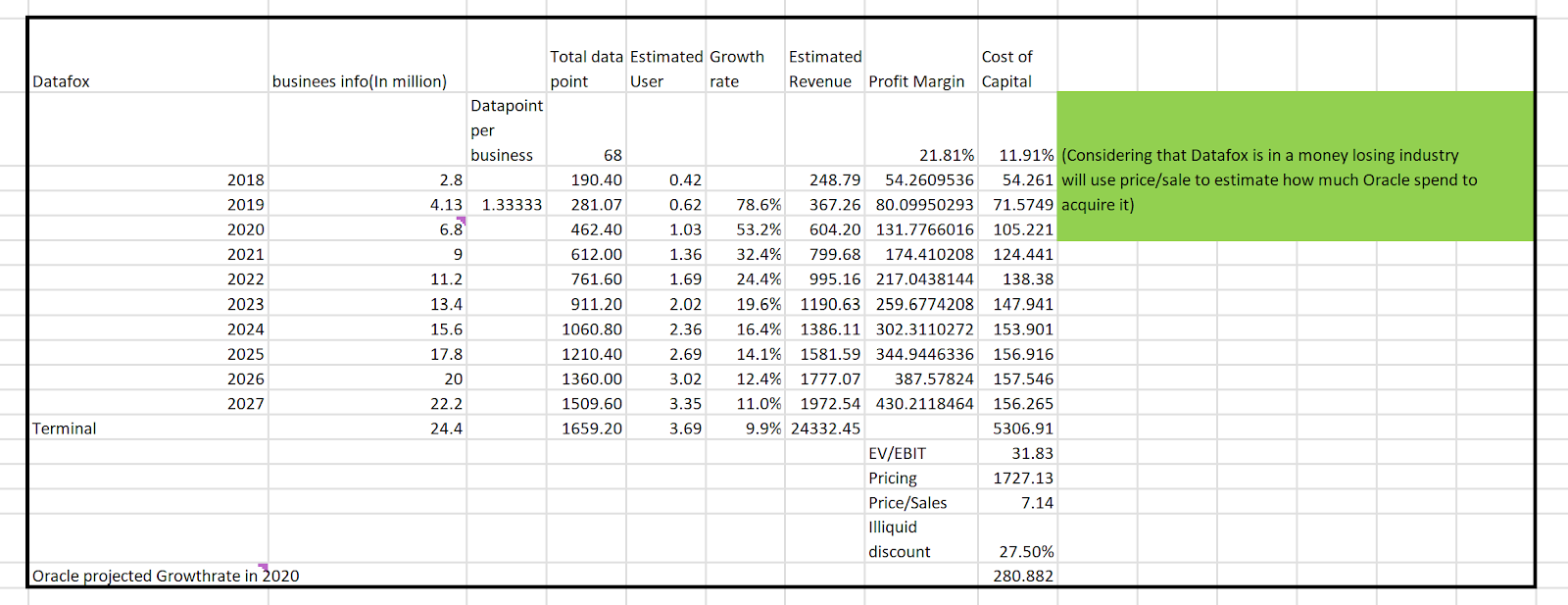

In

2018, Oracle acquired Datafox, a data management company that provides an intelligence platform for B2B(business-to-business) data. So you know, sometimes

if you want to know a random company’s headquarters, management team, phone number,

address, and number. Some website has a list of data for those businesses.

(Datafox platform).

I searched the internet, and the only numerical data I could get from data in this Oracle’s

document,

said in 2020, “it continuously extracts detailed data on more than 6.8 million

public and private business while adding approximately 2.2 million businesses

annually.”. I don’t need to evaluate whether that is a realistic estimate

because I am valuing how much Oracle pays, not how much the company is worth. So, Oracle is likely to pay for the acquisition based on its projection. Then I do I

value the company with the business data account only?

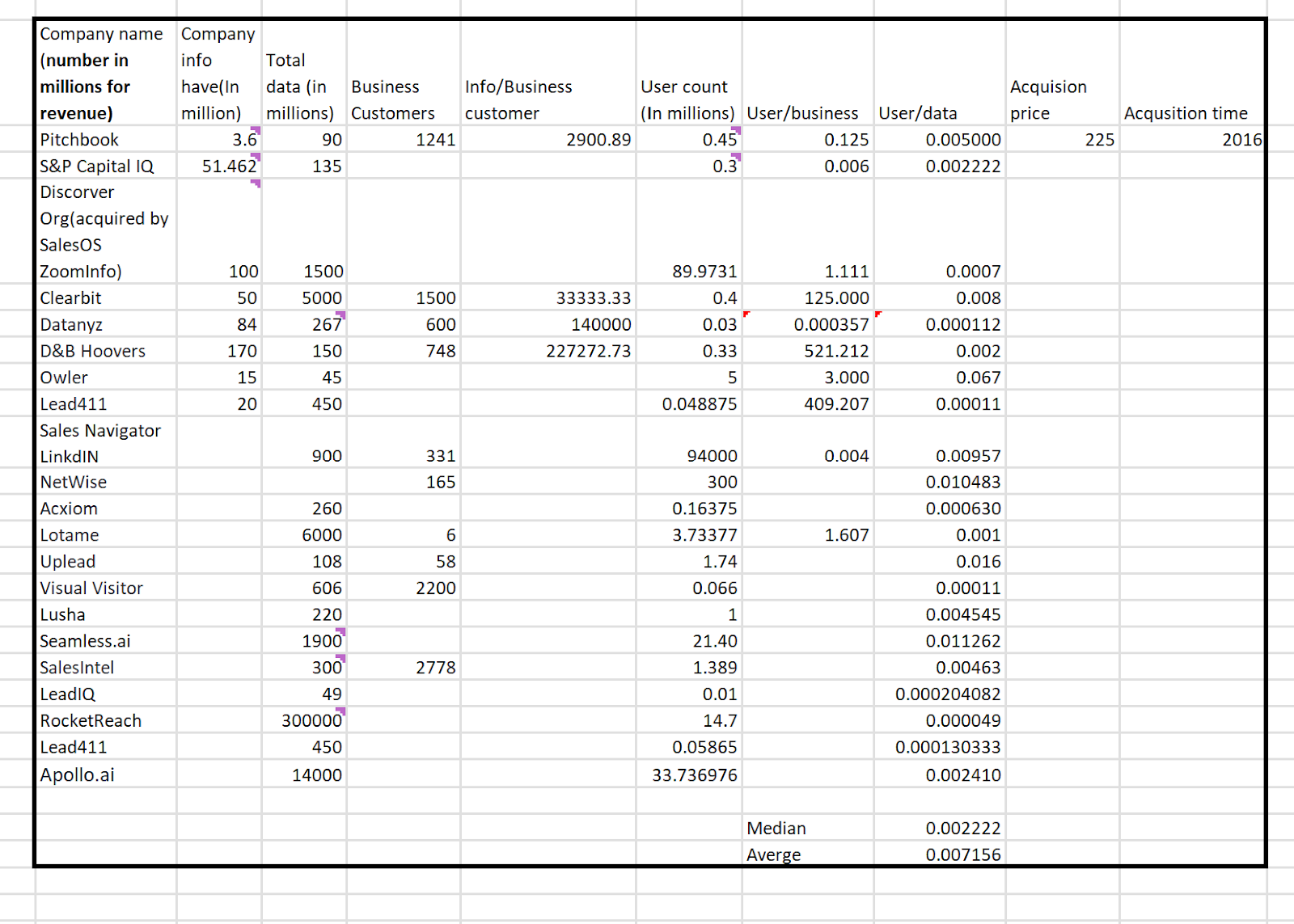

There are many

other companies offering business info data, such as ZoomInfo, Pitchbook, and S&P

Capital IQ, and they are public companies. I collected how much revenue and data

they had. In Figure 5, I find its industry peers but find that only a limited number of numbers disclose the revenues. However, these companies show

how many total users they have. So I calculate the median user per datapoint ratio,

then I multiply the amount to how many datapoints the Datafox has, and I estimate how

many users Datafox has. From this website, I found

that the pricing for Datafox is $49/month. So now I can estimate the revenue

with the price and the total users. Notice that using the EV/EBIT ratio will give

a very different number from using the price/sales. Since my research shows

that the business info is in a losing money industry, I will use the price/sales

ratio, and I estimate that Oracle paid $280.882 million to purchase Datafox.

Figure 5

Datafox

industry

Figure 6

Datafox DCF

3.

No

earning/revenue data, no side data.

In

2018, Oracle acquired Talari Networks, an SD-WAN technology company. To value

the business, I first learned about what SD-WAN is. Put it simply. You know

that when a company has many branches, the company’s center receives millions

of data from branches, conducts security check,s and sends it to the cloud. As the

company has more branches and data, the process can be costly and

time-consuming. A comparison is that visa applications usually go to a

single consulate or embassy in the country’s capital. As the applications increase,

the embassy will have difficulties reviewing them in time. Some embassies and

consulates outsource the work to third parties, such as VFS Global, to do the

initial check for them to filter out unqualified applicants, and the embassy can

conduct interviews after that. The SD-WAN to business network is like the VFS

global to embassies.

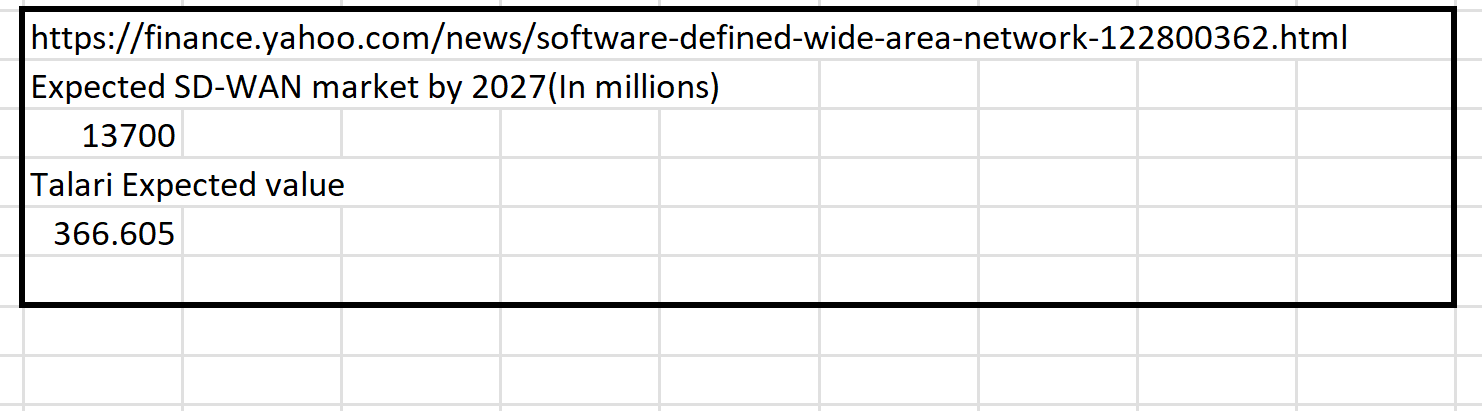

While

I cannot find the sales and prices for the Talari network, I found that Talari network’s

market share in the industry is 2.68%.

Figure

7 Talari Network market share.

Source: IHS Markit.

Then

I multiplied the market share by the expected growth of the SD-Wan market, and I estimated

the value of Talari.

Final

word

Estimating acquisition/private

companies is a challenging task but is doable. Whenever you value M&A, always

have the mindset that this will not be the only company in this industry

in the world, and you can always find some information. The biggest

challenge for most people to value private companies is the uncertainties. In

fact, most analysts do not conduct free cash flow for the same reason. But

using uncertainty as an excuse in valuation is like taxi drivers saying too much driving,

like chefs saying too many ingredients to prepare, like doctors saying too many

patients. Uncertainty is the nature of investment and life and is also the

source of capital gain. If everyone is very certain about a company’s future

growth and earnings, the market price will be the fair value, and no one can

have a large capital gain. So, I recommend embracing the uncertainty since it can be risky and rewarding. Just enjoy it!

Comments

Post a Comment