Term:

Net Capex: this

post refers to the accounting number of capital expenditures less depreciation.

R&D: research

and development

Reinvestment: How

much the company put back into the company

NOWC: Non-cash

current asset-Non debt current liability, the cost the company needs to incur

for day-to-day business.

FCF: Free cash

flow

Operating profit

Margin: Operating income/Revenue

In my previous

Oracle valuation here, I concluded that Oracle relies on mergers and

acquisitions to grow while spending little on capital expenditure and R&D

(research and development) to power internal growth. So, I just use the net

capital expenditure/estimated M&A cost to estimate future net capex.

However, as shown in Figure 1 below, Oracle’s Capex/revenue ratio doubled in 2022 and again in 2023. And the most recent quarterly report shows it does not

plan to stop spending more on capex soon. So, how do I estimate how much Oracle

will spend on Capex in the next ten years?

In addition,

Oracle just announced a partnership with Microsoft, and this post will also

show how the partnership affects the company’s revenue and value.

Figure 1

Before jumping to

the answer, I will first show a wrong example you don’t want to do.

In Figure 2 below,

I calculated the estimated Netcapex based on the current ratio, assuming Oracle

keeps increasing spending for three years and gradually decreases to the industry

average Netcapex.

But as you can see, the intrinsic value jumped from about $80-90 in my last post to $125.36. The

reason is that I included the estimated net accounting capex into the Estimated

Reinvestment, pushing the reinvestment rate and growth rate off the ground.

(To learn more about growth rate, check my previous post here).

But, since Oracle spends almost nothing on and before

2021, including the net capex in the reinvestment, it will

assume each dollar spent on net capex (such as building corporate offices) will generate the same

return as the R&D or M&A.

Solution:

My plan is first to

calculate the industry average capex/revenue ratio, start with a ratio higher

than the industry, and then gradually decrease to the average. In addition, I

will only subtract the estimated capex from FCF, but will not add that to the

reinvestment. By doing so, I expect Oracle to spend that money anyway, even

if it has few or low returns. But there will be a time when the company’s

management realizes that they have spent too much.

Figure 3 shows the

industry average Netcapex/Revenue ratio, and I also calculated the NOWC/Revenue

and R&D revenue. To learn about how to calculate the NOWC (not the

accountants’ way), please check my previous post here.

Figure 3

Based on the data,

we can tell that the industry generally has a negative NOWC rate (implying

increasing free cash flow), and almost 0 net capital expenditure rate. But simply using

the industry average will not reflect Oracle’s current overspending fact.

Figure 4 shows

that most companies (18) in my 22 samples have a net capex/sale revenue between

-4.27% to 3.73%.

Figure 4

I did the same

process for nowc, R&D, and I got the adjusted Oracle intrinsic value in

Figures 5 and 6.

(Before

adjusted for partnership with the Microsoft)

Figure 5

Figure 6

From Figure 5 and 6,

we can tell that without considering the partnership with Microsoft, the

Oracle intrinsic value decreased from the $81.5-$98.05 to $48.91-$72.41 due to

overspending.

Effects of

Partnership with Microsoft

On September 14,

2023, Oracle and Microsoft announced a partnership.

Before the event started, I checked the Oracle price list to estimate by myself first. This step is important because it trains me to make forecasts with imperfect information and can potentially scale up my capital gains. Because the more people in the market know the information, the less potential growth the stock price will have.

But as you can see

from the picture below, Oracle has about 18 product and service categories,

each having 8-10 different pricing. If there is no event to explain, I will

just use the average/median price of the total and estimate the total additional users. However, since I learned the partnership news 2 hours before the event, I decided to

start to value it after watching it.

I watched the live

event between the two CEOs and got the following information:

Microsoft will run

business data in Oracle’s storage on its Azure cloud.

“In order to use

AI, you have to have data. And data are in Oracle database.” (Satya Nadella).

For those unfamiliar

with AI, a large part of AI is to train computers or machines to think and

behave like humans. For example, as humans, we can quickly tell the difference

between a sheep and a cow. But for machines to identify that, you must give

them a bunch of pictures of sheep and cows so that they can learn by looking

enough. These pictures are a kind of data.

Process:

Azure’s enterprise

customers (business customers, companies who are Azure’s customers) will buy

Oracle’s data directly from Microsoft Azure.

The picture below shows how Azure users can purchase Oracle data directly from the marketplace.

(Source: Microsoft

& Oracle Live event)

In addition, the

event gives an example in which Azure users can analyze data based on a bank’s

customers’ data.

(Source: Microsoft

& Oracle Live event)

With this

information, I expect Oracle’s additional revenue from the partnership is from

data storage and data analysis.

Later, I learned

from the CIO journal that the services Microsoft will partner with Oracle are:

Oracle Exadata

Database services

Oracle Autonomous Database services

Oracle Real Application Clusters

(RACs).

I

learned later from the Oracle document that they will gradually replace the Oracle

Exadata Database services with the Oracle

Autonomous Database services, so I just need to care about the last two.

Oracle Autonomous

Database services

I

have no experience or background about these services, but I just did my

research. The service is like a shared warehouse. Imagine there is a furniture

company and a coat company. The furniture company usually needs the warehouse

from the spring to the late fall, while the coat company only needs the

warehouse in the winter. If they collaborate, the furniture company can use the

coat’s warehouse during the summer for extra inventory, while the coat company

can use them in the winter. By doing so, both can save storage costs.

The

Oracle Autonomous Data Services shares data between organizations in such a

way. While the warehouse will calculate the sharing storage by how many square

feet or meters, Oracle Autonomous

Database services

use the ECPU as the billing unit. The ECPU calculates the Price based

on how many hours the company uses the shared pool (pool of data from different

organizations) and how many CPUs(core) are running.

If I know how many organizations are on the Azure cloud, how many cores they have, and how many hours running, I can estimate the incremental revenue to Oracle from the partnership.

This

link

shows how many cores on different sizes of Azure cloud. I calculated the median

# of cores for each size and calculated the average and median of them.

I also learned from my search that about 486738

organizations use Azure. So, I multiplied the number with the median cores and

2080 running times a year; I estimated the increased revenue for Oracle from

Microsoft with the Oracle Autonomous Database services.

While the Oracle Autonomous

Database services have

a Price/ECPU for the new users, it also has another “bring your own license”

price for the current users.

The

Price is $0.336/ECPU/hour for new users while $0.0807/ECPU/hour for “bring your

own license”. So, I just assume all current users pay $0.087 while the

incremental users in the future pay $0.336.

However, one concern is that the total cores will increase in the future. I recall the first computer I used was 1 core, and the 2-core laptop had been regarded as very advanced. But I just checked my computer; it has 4 cores right now. And the most recent Apple Macbook has 10 cores.

But I don’t think I need to make that adjustment. Because even if the laptop increased from 2 to 10 cores, the Price would not increase five times. I just adjusted the Price/ECPU/HOUR over time and will embrace that.

Oracle Real Application

Clusters (RACs)

Before

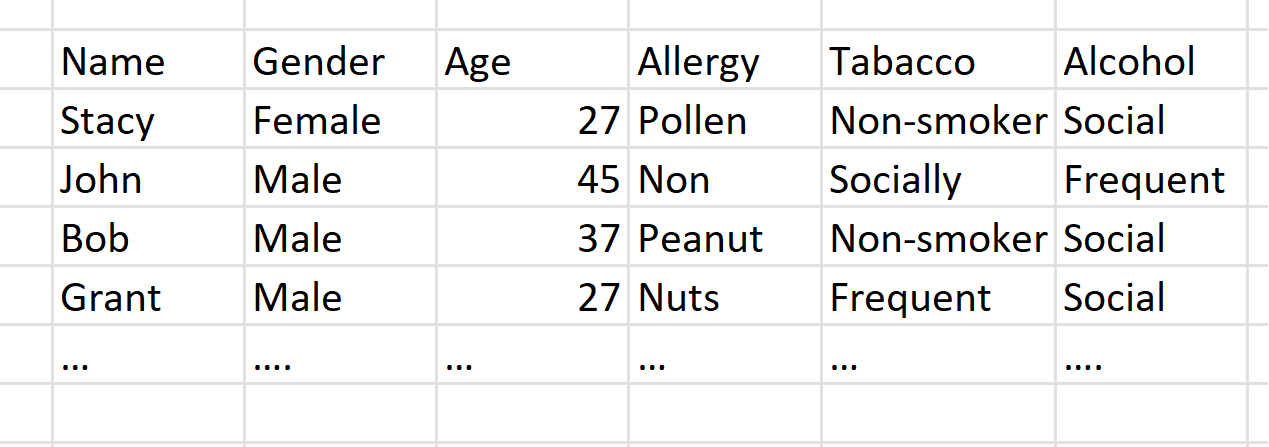

jumping to the RAC, let me first explain how the application works.

Traditionally, the application uses data from data storage. Data storage itself

is just a bunch of files sitting on the disk. For example, a hospital has data

storage for its patients. If you only check the data storage itself, you will

see things like this:

(An example made up by me for explanation)

Without

software to sort the data, it will have few meanings. I know you can tell what

they are based on the context, but for computers and machines, they cannot.

But

with the software, the data will be like this:

So,

the name, gender, age, etc…help the system sort the data. The example is oversimplified; much more complicated software could be needed in the real business.

The

instance in the graph below is Oracle’s software to sort the data.

(Source:Oracle

Youtube Channel)

However, the

instance can stop working sometimes, which will have serious consequences for

businesses relying on data availability. Imagine what happens if the hospital

cannot get patient medicine allergy data.

To solve this problem, Oracle Real Application Clusters enable the system to have multiple instances but collectively appear as one. So even if one of the instances has issues, the system can still keep running, and the application side will not notice anything goes wrong.

Learned

the technology, I can estimate the revenue. Based on its nature, each

organization only needs to purchase one RAC service, and the total incremental

revenue to Oracle will depend on how many organizations are on Azure.

The link below shows the Price for RAC is $460 per named user with a 101.2 support fee. The link is from

2023, so the data is new enough.

https://www.oracle.com/assets/technology-price-list-070617.pdf

Unresolved uncertainty:

Throughout my

analysis for the partnership with Microsoft to Oracle, I have a hard time estimating

how many organizations on Azure will increase in the future. I checked several

sources but found only the most 1-2 years of data. However, I found that the

total number of users on Azure grew almost constantly at 0.2%.

I know this may underestimate future growth, but this is all the information I can get. The worst case is

that I may underestimate the value a little, but I only buy stock when it reaches

my estimated value. If I end up not buying the stock at a higher price, I won’t

lose anything because no gain is not equal to loss.

With this information,

I updated the intrinsic value of Oracle stock as below:

So, I will buy

again if the stock drops to $69.22-$93.32.

The next step is

to estimate how much the trader will value the stock.

In my previous

post, I used the EBIT (earnings before interest and tax) I estimated to

estimate traders’ pricing. But doing so will assume that traders have the same

common sense and patience as I. Recall that when I estimate earnings, I

amortized the R&D, adjusted NOWC to Noncash current asset-Non debt current

liabilities, estimated future merge and acquisition, added back one-time

nonfrequent considerable expense such as litigation cost. But for traders they

don’t care about all of them.

To behave like a

trader, I will multiply the revenue with the unadjusted profit margin.

So, while I use

the 40.49% operating profit margin and gradually decrease it to the 23.43% industry

average in my FCF analysis, I use the

34.39% unadjusted accounting profit margin to estimate how much traders will

price the company.

With this

information, I estimated the traders’ estimate for Oracle’s earnings.

The following

shows what I estimate the traders will price the stock for the next ten years.

I expect the

traders who factored in the Microsoft partnership will price the stock between

$151.53 to $161.87 while those who do not care about the business but only numbers

will price $142.27 to $152.62. If you want to hold the stock, the highest present

value of the future stock price will be around $122.66 to $137.86.

Additional words:

If you compared

the number to my previous post, you may find that the Price changed few,

especially for the traders' earnings.

The reason is that

traders only factor in a few items in the free cash flow analysis.

The Income before income taxes is the only item traders care about.

If your company

doubled the capital expenditure as Oracle did, traders' pricing has no effect.

If your company

has considerable R&D and expects a return after five years, traders will

punish your company for the current earnings without considering future growth.

If your company

has nonfrequent, one-time charges or litigation costs, traders will punish your

stock price for now. But when they do that, they mistakenly assume you will

have that cost every year.

In contrast, the free cash flow analysis I used captured all these effects.

Finally, I do want

to admit that this analysis is based on a very general analysis. If the recent

overspending on capex is mainly driven by the AI boom and Oracle can gradually

reduce the accounting number of capex, the intrinsic value can increase.

If the partnership with Microsoft brings more customers than I expected, the revenue can also soar in the short term. But these are what I can estimate at this moment.

I know many people try to follow the institutions, claiming they must know more than others. But the following are the price targets set by institutions before the recent earning report pushed the stock price down over 10%.

After the earnings, JP Morgan claimed that Oracle stock could decrease more.

One day after that, Oracle announced its partnership with Microsoft.

I hope you find

this post useful.

.jpg)

.jpg)

.jpg)

Comments

Post a Comment